Articles of Interest

Impact of commuted values on the sustainability of defined benefit pension plans

Context

DB plan members whose membership ends before retirement are entitled to the pension accrued during their years of service, to be paid monthly at retirement. They also have the option of transferring the value of their accrued pension out of the plan, subject to certain conditions. By doing so, members are entitled to an immediate lump sum rather than future pension benefits under the DB plan. This lump sum is also known as the “commuted value” of their pension.

Many elements are taken into account when calculating the commuted value, including interest rates. The lower the interest rates, the higher the commuted value, meaning that dwindling interest rates in recent years have driven up commuted values. To illustrate this phenomenon, we’ll use the example of a 35-year-old plan member who ceased membership in the plan and who accumulated an annual pension of $10,000, payable as of age 65. The table below illustrates the value of the commuted value of such a pension based on the termination date.

Commuted values more than tripled over the past 20 years, resulting in the issues we are seeing today.

Termination of membership date | Commuted value |

January 1, 2000 | $35,000 |

January 1, 2010 | $50,000 |

January 1, 2020 | $115,000 |

Risks for members transferring the commuted value OUT OF THEIR PLAN

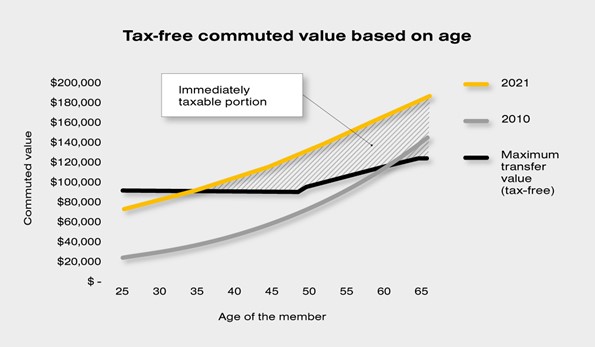

Commuted values can be transferred to retirement savings vehicles, in accordance with the rules set out in the Income Tax Act. These rules specify the value that can be transferred tax-free, also known as the maximum transfer value (MTV). Any amount above the MTV becomes immediately taxable. The sharp increase in commuted values in recent years now means that members whose plan membership ends after age 35 can no longer transfer the full tax-free commuted value of their pension. The taxable portion increases sharply with age, as seen below.

Table 1: Tax-free commuted value based on age. Assumptions: Membership ended on January 1, 2021,

male member, annual pension of $10,000, no retirement allowances.

For a member aged 55, approximately 30% of the transferred commuted value is taxed immediately. The impact is even greater for plans with generous early retirement subsidies. This could have significant consequences on the retirement financial planning of members who choose the transfer, in addition to being a source of confusion for many members who realize, often too late, the real repercussions of transferring their pension’s commuted value out of the plan.

Current tax rules date back to the early 1990s and have not been revised since. However, the original intent was certainly not for pension plan members to bear the brunt of high income taxes at such a young age.

Risks for plan sponsors

Soaring commuted values is also an issue for DB plan sponsors, as lower interest rates have affected the financial situation of pension plans on a solvency basis. Nowadays, many DB plans have solvency ratios below 100%. Under these circumstances, additional contributions are required from DB plan sponsors, both at the federal level and in many provinces.

Furthermore, when members choose to transfer the commuted value of their pension, the current legislation often requires plan sponsors to make additional contributions to the plan to prevent a drop in the solvency ratio. But as commuted values increase, so do the additional contributions required. As workers are more mobile than before, a growing number of members are opting to transfer the commuted value of their pension, thereby exacerbating the situation. This added pressure on funding requirements is a major issue for plan sponsors and threatens the sustainability of DB plans.

The revisions to Section 3500 of the Canadian Institute of Actuaries’ Standards of Practice modified the calculation of commuted values for defined benefit pension plans as of December 1, 2020. The calculations now more accurately reflect the current economic climate. In many cases, the commuted values under the new standards are lower than those under the current standards, especially with regard to target benefit plans and plans with significant early retirement subsidies on termination. While this removes pressure on pension plans, the issue remains.

The Quebec approach

In recent years, certain provinces—including Quebec and Ontario—have eliminated or greatly reduced the funding requirements based on the solvency approach of single-employer DB plans. These modifications helped lower and stabilize the required contributions, thereby fostering the viability of such plans.

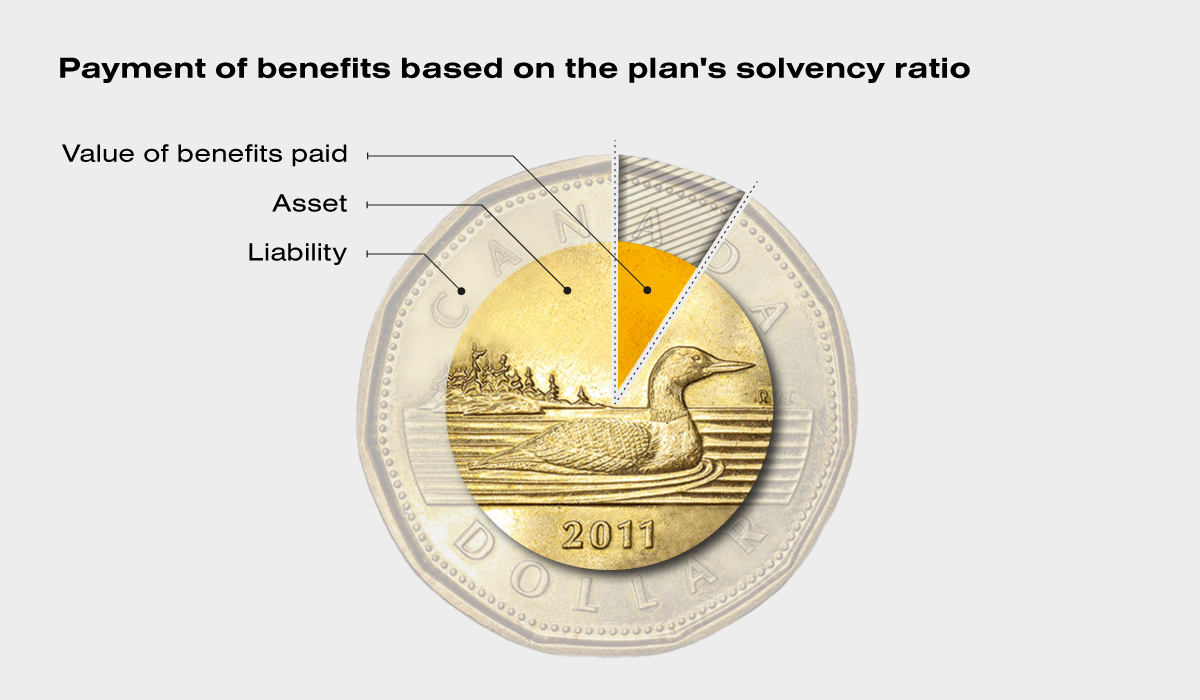

Quebec now allows limiting the final payment of benefits based on the plan’s solvency ratio. With this approach, the value transferred when membership ceases is equal to the commuted value of the member’s pension, prorated to the plan's solvency ratio. The payment is final, and no additional contributions are required. It should be noted that members can always choose to receive a deferred pension from the plan rather than transferring the commuted value out of the plan.

In a context where the plan’s solvency ratio is below 100%, members who choose to transfer the commuted value of their pension will receive their share of the plan’s assets at the time of leaving the plan, as illustrated below.

If the plan were to be wound up that same day, all plan members would receive their fair share of the assets available.

This approach eliminates the plan sponsor’s duty to make additional contributions to the plan. These contributions only benefited members whose membership ended and who opted for transfer. Reducing funding requirements for plan sponsors fosters the sustainability of pension plans.

Conclusion

The Quebec mechanism resolves many of the issues related to increases in commuted values. It’s an approach that’s fair for both members who choose to remain in the plan as for those who opt to transfer out their entitlements. This mechanism can be implemented with ease and fosters the sustainability of pension plans. As these issues are the same throughout Canada, a similar solution should be considered in other provinces as well as at the federal level.

Marilou Forget, FSA, FCIA, Senior Consultant, Normandin Beaudry

Marilou specializes in pension plan administration, but her curious nature led her to explore pension plan consulting (actuarial valuation, accounting valuation, etc.) while studying for her Fellowship. While she enjoyed this rich learning period, her heart and mind brought her back to the administration side. The expertise acquired during that time serves her on a daily basis, adding depth to the advice and support she offers her clients. Marilou serves clients from the private and public sectors, mainly in Quebec, but also for Ontario pension plans with members across the country. She also provides consulting services related to administrative aspects for a large pension plan under federal jurisdiction. Her clients appreciate her devotion, organizational skills, attention to detail, critical mind and excellence.