Articles of Interest

Climate Scenario Analysis: From Information To Emotion To Conviction

1 - Accepting climate change requires more than getting the right data

Climate science is improving our appreciation and understanding of the delicate balance that holds our livable planet together in this vast universe. The scientifical evidence that the industrial age has significantly contributed to global warming is well-documented by various scientific organizations most notably the UN Intergovernmental Panel on Climate Change (IPCC), in their Sixth Assessment Report (AR6) 1. The Paris Agreement ratified in 2016 has rallied 98% of countries in the world towards a common goal of limiting global warming and reaching net-zero by 2050. Yet, the pace of progress toward these goals is slow. The IPCC says that CO2 emissions would need to fall by 45% from 2010 levels by 2030, reaching net-zero by 2050 to limit global warming to 1.5C2. They haven’t significantly fallen from 2010 to 2022. The political will seems to be there but what is causing the slowdown?

George Marshall in his 2014 book “Don't Even Think About It: Why Our Brains Are Wired to Ignore Climate Change”3 says that the problem is human psyche. Humanity has not psychologically evolved to deal with an existential threat like climate change. We tend toward the status quo. We seek short term gains while ignoring the long term implications. One way to break free from the status quo tendency, he claims, is to use storytelling to complement the data absorbed by the rational mind.

“Accepting climate change requires far more than reading the right books, watching the right documentaries, or ticking off a checklist of well-meaning behaviors: it requires conviction - and this is difficult to form and even harder to maintain”.

“Stories are the means by which the emotional brain makes sense of the information collected by the rational brain”.3 George Marshall

I believe climate scenario analysis could provide pension trustees with information that would ignite emotion and would lead to conviction about future actions to take in the best interest of beneficiaries.

2 - Climate scenario analysis as financial and environmental storytelling

Climate scenario analyses (CSA) are used by pension plan sponsors to understand, assess and quantify the risks and uncertainties they may face under hypothetical climate and economic futures. The Canadian Association of Pension Supervisory Authorities (CAPSA) stated in its September 2024 Guideline on Pension Risk Management4 that scenario analysis is a useful tool to help plan sponsors assess climate-related risk and opportunities.

The analysis may vary in complexity from a qualitative exercise to a more quantitative one. It can also be bottom-up, reflecting the individual holdings of a pension plan, or top down by using broad statistics for countries or sectors. The more comprehensive CSA will reveal the expected financial impact of climate change on pension plan metrics such as rates of return, funded status, or contribution rates, to name a few.

To perform a CSA one needs a set of plausible and diverse “stories” or “narratives” of how climate change may unfold and the potential impact of each story on economies, financial institutions and capital markets. The following three sections discuss the evolution of climate scenarios since 2020.

3 - Long term climate scenarios

The IPCC was established in 1988 and produced the first set of climate scenarios. They were typically constructed to support policymakers, not the financial industry. They are “climatic” in nature focusing on modeling the growing concentration of CO2 in the atmosphere, the accompanying rise in global temperature and the impact on Earth’s ecosystems. The horizon used is 2050 and beyond.

Starting in 2020, the Network for Greening the Financial System (NGFS) adapted the IPCC scenarios to assist central banks in exploring the possible impacts of transition and physical risks5 on the economy and financial system. The NGFS scenarios fell under four categories with a low or high degree of transition risk (TR) and physical risk (PR)6 associated with each.

- Orderly scenarios assume climate policies are introduced early and become gradually more stringent. (Low TR, Low PR)

- Disorderly scenarios assume climate policies are delayed or divergent across countries and sectors. (High TR, low PR)

- Hot house world scenarios assume global efforts are insufficient to halt significant global warming. (Low TR, High PR)

- Too little, too late scenarios reflect delays and international divergences in climate policy ambition that imply elevated transition risks in some countries and high physical risks in all countries due to the overall ineffectiveness of the transition. (High TR, High PR)

4 - Narrative mid-term climate scenarios

In 2023 and 2024, the UK Institute and Faculty of Actuaries (IFoA) produced two white papers7 that raised the alarm on the perceived disconnect between climate science and the NGFS worst-case scenarios (Hot-house world, too little too late). The IFoA papers critiqued the limited consideration of the severity of the impacts our global society and financial systems could experience under the worst-case scenarios. The NGFS has addressed criticisms in their subsequent update, however, some of the criticisms still hold.

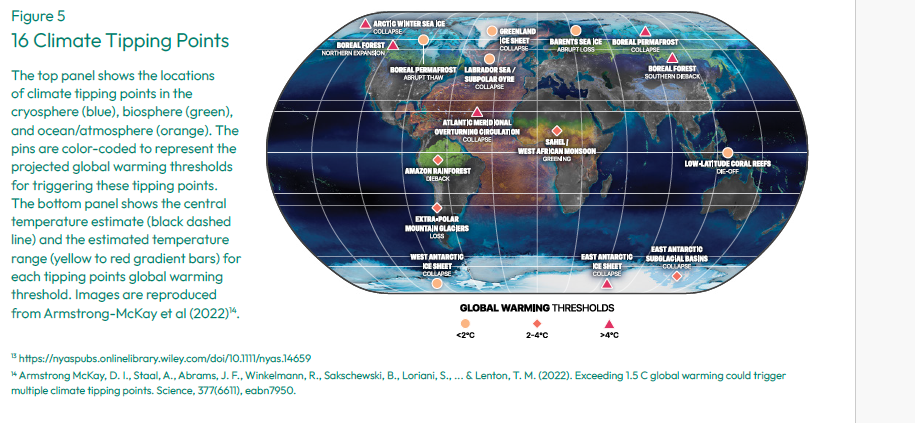

One concern of the IFoA is tipping points, which are ecological thresholds of no return. They could be triggered at a greater frequency, the higher above 1.5C we get. Tipping points include for example, the collapse of ice sheets in Greenland, West Antarctica and the Himalayas, permafrost melt, Amazon die back and the halting of major ocean current circulation. Tipping points could interact to form tipping cascades accelerating the rate of global warming bringing added uncertainty into the picture.

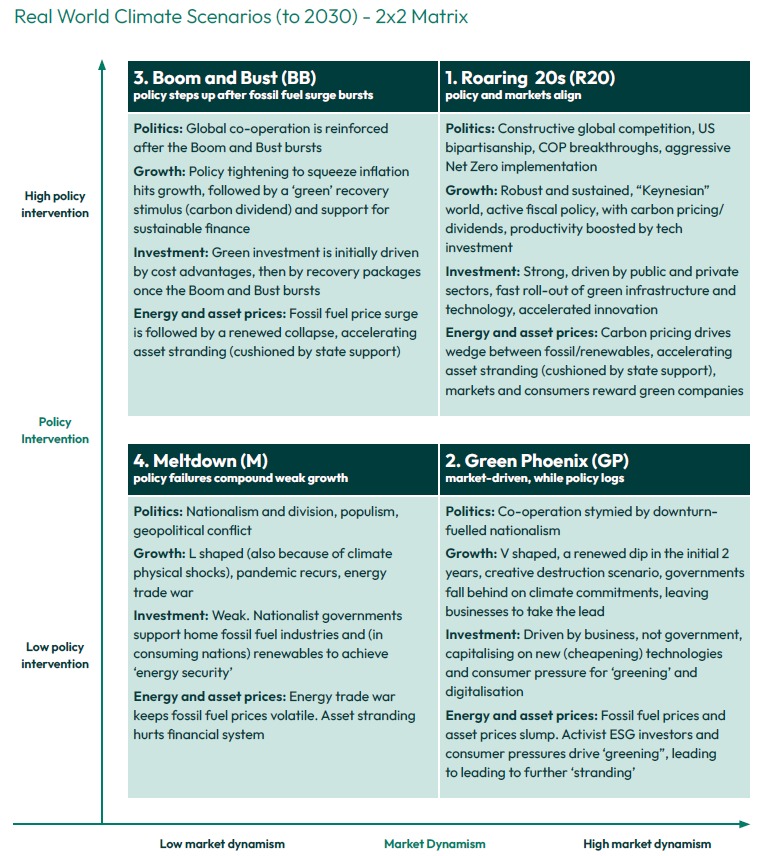

In conjunction with the authors of the IFoA reports, a coalition of academic experts and practitioners from the Universities Superannuation Scheme (USS) and University of Exeter in the UK joined forces to produce more realistic and ‘decision-useful’ scenarios. The Real World Climate Scenarios (RWCS) were released in September 20238 in response to the perceived deficiencies in the NGFS scenarios.

- RWCS are shorter-term (5-10 years) which coincides with the time horizon of asset-liability studies and the investment decisions associated with them.

- Instead of focusing on a precise measurement of the impact of climate risks on plan metrics over long horizons, the narrative nature allows for a more fulsome discussion of the interaction of transition and physical risks with other drivers of financial risks like mass migration, war, political and social instability that could be exacerbated by extreme weather patterns or the crossing of tipping points.

- Climate Scenario analysis using long term scenarios often resulted in benign long term impact to pension plans under the hot-house scenario (3C or 4C world) versus the net-zero scenario. Narrative based scenarios allow for a useful description of the interaction between transition and physical risks and the impact of tipping points and their cascading effects on climate which could lead to planetary insolvency (a term used in the IFoA reports).

The USS Real Word Climate scenarios are represented as a 2x2 matrix of 4 scenarios where the axis refer to key drivers:

- the degree of policy activism i.e. to what extent will governments act through fiscal policy or regulation to drive the transition to net-zero.

- the degree of public and private investment in green infrastructure technology and innovations and consumer response.

A dramatic shift in capital and spending will be needed to reach Net Zero, including the development and rollout of renewable energy and carbon removal technologies. This is unlikely to be the smooth process portrayed by the NGFS orderly scenario mentioned above.

5 - Narrative short-term climates scenarios

In July 2024, the UN Environment Programme Finance Initiative (UNEP FI) Risk Centre and the National Institute of Economic and Social Research (NIESR) issued a report and accompanying excel spreadsheet tool to perform short-term scenario analysis and stress testing of climate risks9. They explore how a set of macroeconomic, transition, and physical shocks evolve and their economic impacts over a five year period. Pension plans sponsors and their advisors can model the impact on their pension plan of one or a combination of these above shocks.

It is quite conceivable that more short- or mid-term climate scenarios could be produced in the future by service providers, large pension plans or think tanks organizations.

6 - Implications for trustees of pension plans.

CAPSA in its latest guideline4 said that “ignoring or failing to consider ESG information (including climate-related risks and opportunities) that might materially affect the fund’s financial risk-return profile could be a breach of fiduciary duty.”

If they haven’t started, pension plan trustees would be wise to:

- Dedicate regular trustee meeting time on absorbing the latest knowledge about climate science, regulations/standards, climate scenarios and the implication on risk-return.

- Engage in guided conversations with key stakeholders on important topics such as:

- Reviewing the plan purpose(s) in light of climate change and the evolution of fiduciary duty

- Primary purpose: diligent management of assets to provide lifetime retirement incom

- Secondary purpose? alignment of the plan with collective effort to move the transition toward Net-Zero, with interim targets, in the financial best interest of beneficiaries.

- Materiality of climate-related risks given the nature of the plan, horizon, demographics, size etc.…

- Risk, uncertainty and opportunities linked to climate change and the use of climate scenario analysis to assess these

- Benchmarking climate-related risk management and disclosures practices of comparable or best-of-class plans

- Adoption of a climate strategy to integrate climate-related risks & opportunities in plan governance, investment decision-making, stewardship, target setting (interim and long term) and reporting.

- Reviewing the plan purpose(s) in light of climate change and the evolution of fiduciary duty

Conclusion

Science is unequivocal that human-caused increase in CO2 in the atmosphere over the last 150 years has altered the climate equilibrium to the point where a global, gradual but decisive response is needed to avoid planetary insolvency. As a society, we know what to do to “course correct”. Climate scenario analysis is a tool that can shed light on risks, uncertainties and opportunities pension plans are exposed to as humanity moves forward on this process. The more recent short- and mid-term narrative based scenarios have the potential to be decision-useful and can strengthen the conviction needed for plan trustees to take appropriate action.

1 - IPCC Sixth Assessment Report - Working Group 1 The Physical Science Basis

4 - CAPSA Guideline for Risk Management for Plan Administrators (capsa-acor.org)

5 - For a definition of Transition and Physical risks see: FINAL-2017-TCFD-Report.pdf (bbhub.io)

7 - Emperor’s New Climate Scenarios – a warning for financial services (actuaries.org.uk)

Climate Scorpion – the sting is in the tail (ifoa-prod.azurewebsites.net)

André Choquet, FCIA, FSA, CIM, President, Mathalian Partners

A qualified actuary (FCIA, FSA) and a Chartered Investment Manager (CIM) with 30 years of experience as a trusted advisor to pension plans in governance, funding, investing, ESG integration and management of climate-related risks and opportunities.

André founded his firm to advise asset owners on their journey from being a traditional Institutional Investor to a Responsible Institutional Investor. The development and implementation of climate strategies are his passion and expertise.

André was Director at an ESG advisory firm developing Responsible Investment policies for pension plans and other investors. He once was the lead client portfolio manager for a $1.5B university endowment advising on the implementation of TCFD recommendations. He pioneered the Outsourced Chief Investment Officer (OCIO) practice at a major global consulting with AUM growth from $0 to $7B in 9 years.

André holds a BSc. in Actuarial Mathematics from Concordia University. He received the 2022 Canadian Institute of Actuaries (CIA) President Award for his role as Chair of the CIA Climate Change and Sustainability Committee (2021-22) and his dedication in progressing the integration of climate change in the practice of the Institute’s 6,000 members.

He is an experienced speaker and author on a variety of pension topics.