Articles of Interest

How Retirement Investments Align with Long-Term Environmental Goals

What do retirement plan sponsors and sustainable investors have in common? A focus on the long term. We explore how different asset classes, particularly real assets, can be aligned with long-term climate-related objectives, such as reducing carbon footprints to net zero.

Key takeaways

- Climate-related risks and opportunities are present in virtually all asset classes, but real assets may offer relatively stronger profiles of climate resilience to investors.

- As the world transitions to a low-carbon future, exposure to and within specific asset classes can be optimized to maintain alignment with climate and other environmental goals.

- As DB plan sponsors consider assigning mandates and DC plan sponsors build and monitor fund lineups, these fiduciaries can also be mindful of how retirement portfolios can align with key climate goal milestones.

Taking the long-term view

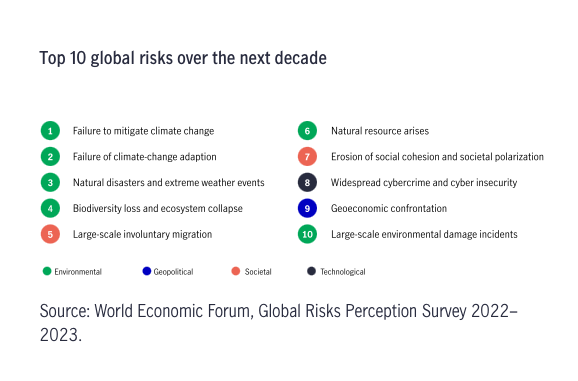

A typical retirement portfolio and a sustainable investor have at least one shared aspect: They both have a long-term horizon. Consider also that six of the top ten risks over the coming 10-year period are climate and environment related, according to the World Economic Forum, and the time frames for making changes to avoid economic and social damage from climate change are closing.

Indeed, investment portfolios focused on long-term return objectives will be less likely to achieve them if climate change mitigation and nature and biodiversity regeneration aren’t also achieved on a global scale.

So how can investment portfolios be built to align with these important and financially material environmental themes?

Measuring the relative preparedness and resilience of different asset classes

Net zero refers to negating the amount of greenhouse gases (GHG) caused by human activity by reducing emissions and using tools to absorb carbon dioxide from the atmosphere. Emissions themselves are categorized into scope 1, direct emissions; scope 2, indirect emissions; and scope 3, indirect emissions, up- or downstream in the company’s value chain.

When investing through the lens of climate risk, two high-level metrics that are useful to measure the relative preparedness and resilience of different companies are disclosures and targets; specifically, whether a company has:

- Measured and reported on its scope 1, scope 2, and scope 3 emissions

- Set a net zero emissions target by 2050

Using these data points as proxies for preparedness and resilience in the face of both climate change and the transition to a lower-carbon economy, we can assemble asset class-based measures of the same using broader market indexes.

Prevalence of net zero targets among major asset classes

Asset class | Index proxy | Companies reporting GHG emissions (scope 1 and scope 2) | Companies with self-declared net zero targets |

Global infrastructure | S&P Global Infrastructure Index | 89% | 54% |

Global real estate investment trusts | MSCI World Real Estate Index | 86% | 25% |

Global large-cap equity | MSCI ACWI Index | 74% | 35% |

Canadian all-cap equity | S&P/TSX Composite Index | 65% | 23% |

Canadian core fixed income | FTSE Canada Universe Bond Index | 45% | 16% |

Canadian long duration core fixed income | FTSE Long Term Canada Bond Index | 38% | 14% |

Source: Manulife Investment Management, Bloomberg. Data is as of March 30, 2023. The S&P Global Infrastructure Index tracks the performance of companies from around the world that represent the listed infrastructure industry while maintaining liquidity and tradability. The MSCI World Real Estate Index tracks the performance of mortgage companies, property management companies, and real estate investment trusts. The MSCI All Country World Index (ACWI) tracks the performance of large- and mid-cap stocks of companies in developed and emerging markets. The S&P/TSX Composite Index is the benchmark Canadian index that tracks the performance of companies listed on the Toronto Stock Exchange (TSX). The FTSE Canada Universe Bond Index tracks the performance of marketable government and corporate bonds outstanding in the Canadian market. The FTSE Long Term Canada Bond Index tracks the performance of marketable long-term government and corporate bonds outstanding in the Canadian market. It is not possible to invest directly in an index.

In these terms, real assets, such as global infrastructure and global real estate, are ahead of other asset classes when it comes to measuring their scope 1 and scope 2 emissions, and infrastructure leads in terms of setting net zero targets. This reflects several factors, including real assets’ generally higher exposure to both physical climate risk and low-carbon transition risk (and, therefore, more proactive risk management and reporting), government regulation regarding emissions reporting, investor and client demand for climate risk information and action, and the growth of opportunities in these industries, such as green buildings and renewable energy.

Both the global and Canadian equities asset classes follow closely behind. The high prevalence of sovereign issuers, subsovereign issuers, and other government-owned corporate issuers in Canadian fixed-income strategies may explain the lower rates of scope 1 and scope 2 reporting and net zero strategy setting. Although the Canadian government itself has a net zero target and strategy, the debt-issuing entities themselves don’t necessarily report on their climate risks and opportunities as commonly as public issuers do.

Aligning equities and fixed-income investments with climate-related goals

There are several different reasons to align with a net zero emissions target by 2050 investment strategy: avoiding the risk of high carbon assets; aligning with, and accelerating, the low-carbon transition; and capitalizing on opportunities in companies that are positioning themselves to be more competitive in a low-carbon future. There are several ways equity and fixed-income investment managers can align with a net zero by 2050 target. Defined benefit (DB) and defined contribution (DC) plan administrators can assess different strategies’ alignment by considering whether they:

- Invest in climate leaders—Investors can focus on companies deemed to be leading the low-carbon transition through their products and services and/or in the way they operate. Some companies are ramping up their cleantech revenue, while others are finding ways to shift off fossil fuels at scale and/or make a difference in their value chains.

- Invest in the low-carbon transition—Investors can seek out opportunities to help finance the low-carbon transition by finding higher emissions companies that have a credible low-carbon transition plan with short- and longer-term targets and that have made demonstrable progress. Industries that are contributing to the low-carbon transition include materials, electrification, transportation, renewable power generation, and technology.

- Invest in the environmental, social, and governance-labeled bond market—Green, sustainable, and transition bonds make up a new and fast-growing market segment. Often, they’re linked to the issuer meeting environmental objectives through the use of proceeds (i.e., the issuer specifies that the funds will be used for decarbonization projects) or through terms and conditions (i.e., if prespecified sustainability targets such as emissions reductions aren’t met, the investor is compensated with additional basis points).

- Engage with or avoid high emitters—Engaging with high-emitting portfolio companies to help them set and act on credible transition plans can be a powerful tool. This can involve speaking directly with boards of directors and voting on or filing shareholder proposals related to climate risk.

Exploring capabilities in sustainably managed real assets

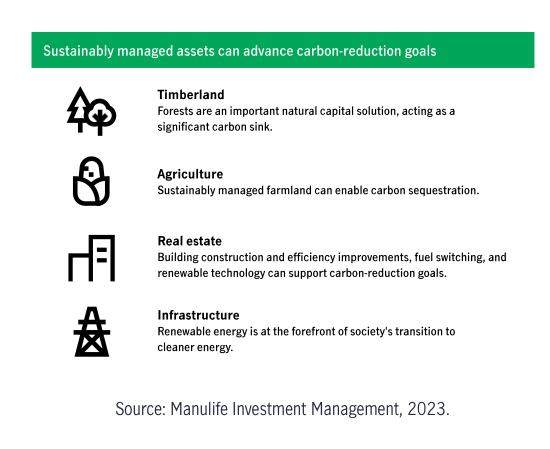

Real assets benefits in terms of diversification, inflation protection, and income are well known, but they also provide investors an opportunity to play a role in climate change mitigation and adaptation. Real assets such as agriculture, timberland, and real estate innately contribute to meeting basic human needs for food, materials, and shelter, while infrastructure contributes to essential water, energy, and transport services. When managed sustainably, we believe these asset classes can play a critical role in addressing climate change, nature loss, and rising inequality. Moreover, investment in sustainable timberland and agriculture can provide low-cost natural climate solutions that may also act as a first line of defense for protecting and enhancing biodiversity. As carbon measurement practices continue to evolve and more investors and companies begin to assign explicit financial value to carbon sequestration and ecosystem services such as clean air and water, we believe that these attributes of natural capital will become more valuable.

Renewable energy, a necessary component of the low-carbon transition, is central to sustainable opportunities within the infrastructure asset class. Technological advances, such as precision agriculture, are key to achieving greater efficiency in the use of scarce inputs, lowering emissions, minimizing waste, and reducing the farming sector’s carbon footprint. Meanwhile, real estate assets are vital to reducing the built environment’s carbon footprint, and we believe investors will increasingly demand building efficiency improvements, fuel switching, and renewable technology that support carbon-reduction goals. For landlords, the benefits of having so-called healthy buildings include attracting quality tenants, while such properties can potentially attract tenants who are willing to pay higher rents for sustainable spaces.

Retirement plan managers and stewardship

According to the Thinking Ahead Institute’s 2022 Global Pension Assets Study, the number one missed opportunity for pension funds over the last 20 years is stewardship. For retirement plan administrators, this includes fundamental activities of plan and risk management, including controlling strategy selection and oversight and overall asset allocation. Understanding how sustainability issues can affect economic development and how that may translate into capital market outcomes is an essential part of this process.

As a multi-asset manager, we know that sustainability factors play a meaningful role in today’s macroeconomic conditions and that regular engagement with investment managers is central to the project of assessing the rigor of their approach to sustainability and a key step in determining how well individual investment strategies fit into a broader multi-asset strategy. Retirement plan administrators have no small stake in understanding sustainability imperatives and related investment strategies. Without this capacity, we think asset owners and their beneficiaries could be subject to significant downside risks in their long-term portfolio outcomes. But with it, DB and DC plan sponsors are better prepared as stewards of capital. Developing a broad understanding of sustainability practices across a variety of asset classes is an important step in weighing all the relevant risks and opportunities confronting a retirement plan’s underlying investments—and, in our view, an indispensable part of investing for the long term.

Important disclosures

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

Any ESG-related case studies shown here are for illustrative purposes only, do not represent all of the investments made, sold, or recommended for client accounts, and should not be considered an indication of the ESG integration, performance, or characteristics of any current or future Manulife Investment Management product or investment strategy.

Manulife Investment Management conducts ESG engagements with issuers but does not engage on all issues, or with all issuers, in our portfolios. We also frequently conduct collaborative engagements in which we do not set the terms of engagement but lend our support in order to achieve a desired outcome. Where we own and operate physical assets, we seek to weave sustainability into our operational strategies and execution. The relevant case studies shown are illustrative of different types of engagements across our in-house investment teams, asset classes and geographies in which we operate. While we conduct outcome-based engagements to enhance long term-financial value for our clients, we recognize that our engagements may not necessarily result in outcomes which are significant or quantifiable. In addition, we acknowledge that any observed outcomes may be attributable to factors and influences independent of our engagement activities.

We consider that the integration of sustainability risks in the decision-making process is an important element in determining long-term performance outcomes and is an effective risk mitigation technique. Our approach to sustainability provides a flexible framework that supports implementation across different asset classes and investment teams. While we believe that sustainable investing will lead to better long-term investment outcomes, there is no guarantee that sustainable investing will ensure better returns in the longer term. In particular, by limiting the range of investable assets through the exclusionary framework, positive screening and thematic investment, we may forego the opportunity to invest in an investment which we otherwise believe likely to outperform over time. Please see our ESG policies for details.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than a century of financial stewardship to partner with clients across our institutional, retail, and retirement businesses globally. Our specialist approach to money management includes the highly differentiated strategies of our fixed-income, specialized equity, multi-asset solutions, and private markets teams—along with access to specialized, unaffiliated asset managers from around the world through our multimanager model.

This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Brazil: Hancock Asset Management Brasil Ltda. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which is authorised and regulated by the Financial Conduct Authority United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

Émilie Paquet, FSA, Head of Strategic Initiatives and Innovation, Multi-Asset Solutions Team, Manulife Investment Management

Emilie is accountable for driving forward strategic initiatives to support the objective of Manulife Investment Management being a recognized leader within the multi-asset solutions industry. She contributes to the strategy to grow the solutions business, building awareness, and executing upon key initiatives to support that strategy. Emilie joined the firm when Standard Life's Canadian operations were acquired by Manulife in January 2015. Prior to joining Standard Life Investments, Emilie was an investment consultant at Watson Wyatt Worldwide. Émilie holds the Fellow of the Society of Actuaries designation.

Education: B.Sc., Actuarial Science, Université Laval

Joined the company: 2015

Began career: 2002

Alyson Slater, Head of Sustainable Investing Canada, Sustainable Investing Team, Manulife Investment Management

Alyson Slater leads ESG and sustainable investment in Canadian public markets. Her responsibilities are to help integrate ESG into many aspects of the firm’s work including products, compliance, research, engagement with issuers, and interacting with clients and stakeholders. Prior to joining the firm, Alyson founded the climate risk and sustainable finance practice at the Global Risk Institute in Financial Services where she developed leading research and education programs for Chief Risk Officers and Board Directors. Alyson has specialist knowledge in sustainability reporting and disclosure through her decade as an executive at the leading international ESG standard setter based in Europe. She has worked with issuers across all major sectors and regions on sustainability strategy, management and reporting in various consulting roles. Alyson also spent five years in Asia with the Alliance for Financial Inclusion working with financial sector regulators across 75 developing and emerging economies to make financial systems more green and inclusive. Alyson is a member of the Canadian Sustainability Standards Board.

Education: BA (Hons) Geography and Environmental Studies, McGill University; MA Resource Management and Environmental Science, University of British Columbia

Joined the company: 2022

Began career: 2000

Vishal Mansukhani, CFA, Global Multi-Asset Client Portfolio Manager, Multi-Asset Solutions Team, Manulife Investment Management

Vishal is responsible for client portfolio management for strategies managed by the firm’s multi-asset solutions team (MAST), primarily focused on supporting the team’s liability-driven investment (LDI) business, fixed-income ETFs managed by MAST, and outsourced chief investment officer efforts across all channels in Canada, the United States, and Asia. Vishal comes from Fiera Capital, where he held the position of vice president, institutional portfolio manager, focusing on servicing existing institutional client relationships as well as the growth and expansion of Natixis investment managers in Canada. Prior to joining Fiera, Vishal spent six years at CIBC Asset Management as vice president, institutional sales and client solutions, focused on the growth and expansion of CIBC’s multi-asset, currency management, fixed-income, and LDI business. He has also held positions at Morningstar Research and Excel Funds Management (SunLife Global Investments), and holds the Chartered Financial Analyst designation.

Education: M.B.A., Queen’s University

Joined the company: 2022

Began career: 2011