Articles of Interest

Is your Portfolio Allocated to this Time-Tested Winner?

Over the last several years, pensions and endowments have been reducing allocation to Canadian equities and the value style of investing; this move isn’t surprising given the hype around global investments and the focus on growth-oriented stocks over the last decade. However, as value managers we continue to find attractively valued opportunities with strong balance sheets and capable management teams, and believe the Canadian market has the potential to offer patient investors some of the most attractive returns, globally.1 History supports this belief, with data suggesting that investors should consider allocating more to Canadian value…and now may be the most beneficial time to do so.

Are Fundamentals Driving the Shift Away from Canada?

One can simply look at the country allocation in the MSCI World Index to see how pension plans can justify a reduced allocation to Canadian equities. As of February 2024, the U.S. accounts for roughly 71% of that index (next largest is Japan at 6%), while Canada represents a mere 3%. Pensions (and individual investors) may look to that Index for performance measurement, but it should not be the sole guide for portfolio construction. Many investors are looking beyond Canada to the U.S. market, which seems to be gaining attention and strength every day. Last year was a particularly strong one for the U.S., with the S&P 500 outperforming the S&P/TSX Composite Index by a staggering 11.1%. However, the U.S.’ outperformance relative to Canada was largely due to the dominance the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) has over the U.S. market. While it’s currently driving performance, this dominance is a risk – what happens to the U.S. and global markets when the bubble bursts? Trees don’t grow to the sky and the Magnificent Seven are collectively trading at an average of 29x their forward earning projections, up from 22x at the end of 2022 and compared to just 18x for the S&P 500 excluding these seven securities.2

This shift of moving away from domestic investing is not exclusive to Canadian pension plans, as other developed markets have seen similar trends. However, it has impacted Canada more than most other major developed nations, with Canadian pension funds holding just 4% of their total assets in Canadian equities today, compared to 28% 20 years ago.3 In contrast, by government edict, pension plans in Australia, a similar sized economy to Canada, invest roughly 25% of total assets in domestic equities, contributing greatly to domestic job creation, innovation and growth.4 Surely a Canadian decline as significant as this must be supported by fundamentals – that Canada has become too expensive relative to other markets? Or perhaps riskier than others? History suggests that’s simply not the case. Looking at data from Dimson, Marsh and Staunton that covers over a century of data (1900-2023), the Canadian market has in fact offered an above-average, long-term return with a below-average, long-term standard deviation compared to other countries over that time.

Despite Canada’s impressive long-term history, Canadian pension and endowments continue to move away from investing in their home country. Recently, an open letter was signed by almost 100 Canadian business leaders to Finance Minister Chrystia Freeland and her provincial counterparts to encourage investment in Canada. In response, some pension plans suggested their investments have done better by not investing in Canada. They used the U.S. as a comparison and focused on a 10-year time horizon in which Canada underperformed. The problem with that 10-year time horizon is that it’s focused on a time where the U.S. market reached historically high levels largely thanks to the current AI frenzy – a potential bubble similar to the 1990s tech bubble; not necessarily a market that is sustainable. A longer-term dataset offers more insight and can reflect a more “normalized” market. As the following table demonstrates, even just extending the time horizon back to 2000, the Canadian market’s annualized return since then has been in-line with the U.S. market and outperformed the MSCI World. This +20-year period incorporates data from market downturns rather than focusing solely on a time where the U.S. market has been at its strongest.

Jan. 2000 – Dec. 2023 | Annualized Return (CAD)* 5 |

S&P/TSX Composite | 6.6% |

S&P 500 | 6.6% |

MSCI World | 5.4% |

MSCI Canada | 6.6% |

*Gross Total Returns.

The term “chart crime” is used to describe a form of data manipulation where individuals only display specific time horizons that support their points. Therefore, it’s important for investors to remember to look at the full story that long-term data offers, and why we ultimately lean on the +123 years of Dimson, Marsh and Staunton data that suggests Canada is an attractive market to invest in. The rest may just be market noise covering up the truth.

Price Matters

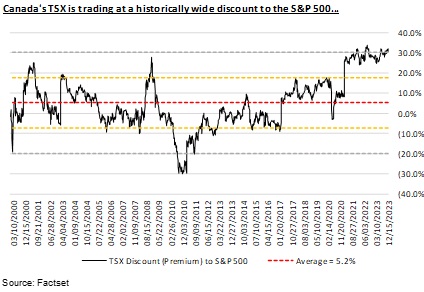

Jakob Fugger the Rich advised 500 years ago to regularly rebalance asset mix by trimming gainers and adding to weaker assets, and he was the richest man of his era. Savvy investors know that one of the most significant impacts on your returns is the price you pay, and right now Canada is looking very attractive. The Canadian market is the cheapest it has been relative to the U.S. in over 40 years, at two standard deviations below normal – suggesting a reversion is likely.6 The last time the Canadian market was this cheap relative to the S&P 500, Canada outperformed the U.S. by approximately 9% and the MSCI World Index by roughly 8% over the following 11 years.7 As value investors, we are always looking for a great deal on a strong investment. As the following chart demonstrates, the Canadian market certainly looks attractively valued these days.

The cheapness of the Canadian market is further confirmed by two attractive characteristics:

- Price-to-Book Value (P/BV): Canada’s S&P TSX Composite Index has a P/BV approximately half that of the S&P 500

- Dividend Yield: The S&P TSX Composite Index’s dividend yield is roughly double that of the U.S

Historical Data Suggests a Switch Back to Canadian Value Equities is Justified

Historical data helps us identify trends and understand what is likely to happen in similar situations in the future. Recently, studying history has been especially useful when it comes to understanding inflationary trends and which investment style typically performs well in different environments. It’s useful to understand that most professional investors today have never had to operate in an inflationary environment.

Looking back more than 80 years to 1941, we can see a similar period to the one we’ve experienced recently where rates shifted from disinflation to inflation. During this inflationary time from 1941 to 1951, investors saw the value style of investing outperform growth in the immediate aftermath of the switch (13% annualized advantage over growth).8 Value’s outperformance was largely sustained until rates fell low enough in 2011 to begin a long-term outperformance of the growth style, once again, similar to the deflation experience in the 1930s. Professor George Athanassakos’ research also demonstrates when inflation is 2.5% or better, the value style outperforms growth by 11% in rolling three-year periods.9

Some investors are suggesting value’s time to shine has passed, especially now that inflation seems to be subsiding somewhat. There’s been much speculation around how quickly inflation will drop below 2%, and once again history helps guide us to an answer. Data from BofA suggests that when inflation rose above 5% in advanced economies between 1980-2020, it took on average 10 years to drop down to 2%. This suggests we are still early in the game for inflation to decline back to these levels, so there’s still plenty of time for investors to make the switch back to value and take advantage of the potential outperformance. Recall that many investors expected multiple interest rate cuts in 2023, but stubborn core inflation has proven stickier than originally expected by many.

The grass is not always greener elsewhere. We encourage plan sponsors to stress test the resiliency of their asset allocations and consider whether further allocations to Canada and value investing may support their risk-adjusted investment goals. Canada has provided long-term investors some of the highest real equity returns with lower risk as measured by standard deviation – this is a fact. So, while it’s easy to get caught up in the latest hype in the markets, it’s important to remember to take a step back and learn from the lessons history can teach us.

1 Plexus Asset Management (data from Prof Robert Shiller and I-Net Bridge). As at September 30, 2012.

2 FactSet and Sionna Investment Managers. As at February 29, 2024.

3 Letko Brosseau. Canadian Pension System’s Divestment of Canadian Assets: The Canary in the Coal Mine.

4 Investment Magazine. Australia Tops Charts for Pension Assets-to-GDP Growth Ratio. February 2024.

5 FactSet and Sionna Investment Managers. As at December 31, 2023. S&P 500 CAD returns calculated using estimated exchange for periods between 2000-2002.

6 Scotiabank GBM Portfolio Strategy, Refinitiv. 2022.

7 FactSet and Sionna Investment Managers, 2022

8 Eugene Fama & Kenneth French. Ronald Blue Trust. 2019

9 George Athanassakos. Ben Graham Centre for Value Investing. October 2021.

Kim Shannon, CFA, MBA, Founder and Co-Chief Investment Officer, Sionna Investment Managers

Kim founded Sionna, one of the largest independent investment firms led by a woman, in 2002. Kim is the lead Portfolio Manager on Sionna's large cap, all cap and focused Canadian value strategies and co-lead on Sionna's high conviction strategy. Since joining the industry in 1983, she has received numerous awards, including Morningstar Fund Manager of the Year (2005), the RBC Canadian Woman Entrepreneur Award (2007), Canada’s Most Powerful Women: Top 100 Award (2007, 2017), the Rotman Women in Management Association Top 10 Award (Entrepreneur Category, 2015) and the Rotman Alumni Lifetime Achievement Award (2021). Kim was also inducted into the IIAC Investment Industry Hall of Fame in 2022. Kim is on the board for the Brandes Institute, Ontario Arts Foundation and United Corporation. She is also a member of the CFA Institute Board of Regents (previously served as its chair) and is a past President of the CFA Society Toronto. Kim served as a board member with the Canadian Coalition for Good Governance and served as Chair of its Governance Committee. Kim was amongst a select group of industry experts to present at the 2020 Columbia Business School’s “From Graham to Buffett and Beyond” Omaha Panel. Kim also co-hosted the female-led Variant Perspectives Value Investing Conference in 2019, which featured Warren Buffett as a keynote speaker.