Articles of Interest

Liability-Driven Investing (LDI) Plus – Looking Beyond Annuities & Public Bonds to De-Risk the Plan

Key Points

- Defined Benefit (DB) pension plan financials ended 2022 on a solid footing, improving the capacity to take meaningful de-risking actions

- As DB plans look to de-risk at reasonable costs, pension plans may find it beneficial to consider a broad range of investment options

- Completing a core bond allocation with private credit and income-oriented alternative strategies can help achieve important savings over other frequently pursued de-risking approaches, without materially increasing the funded status volatility or downside risk

The stronger the wind, the stronger the trees

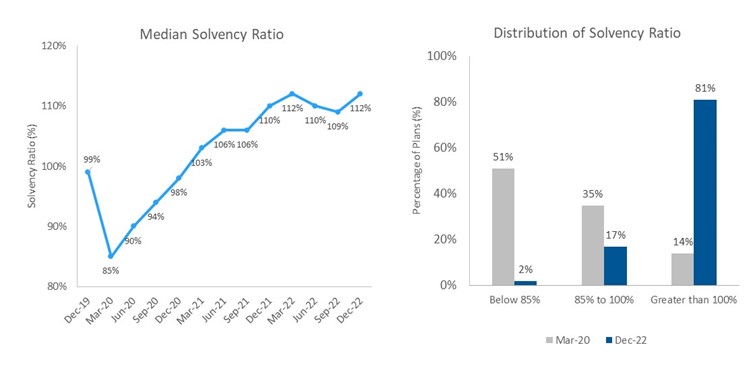

Despite the recent market turmoil, Canadian Defined Benefit (DB) pension plan financials are on a solid footing, even following the financial and economic storm induced by the COVID pandemic. While volatility is still abundant, the solvency ratio of Canadian plans has improved over the past three years according to data tracked by several consulting firms as well as those reported by regulatory bodies. For instance, according to the Financial Services Regulatory Authority of Ontario (FSRAO), the median Ontario defined benefit pension plan had a solvency ratio of approximately 85% in Q1 2020. At the end of 2022, the pendulum has swung in the other direction with the median pension plan having a funded ratio of 112% and over 80% of plans boasting a funded ratio greater than 100% (see below).

Source: Financial Services Regulatory Authority of Ontario.

For many plans, the time is right to seriously consider taking some de-risking actions.

For plans that find themselves in the envious position of being able to take some risk off the table, the natural question is, ‘Now what?’

The De-Risking Journey Has Multiple Paths

A key de-risking lever for pension plans is to shift the asset mix from return-seeking toward liability-hedging assets, i.e., increase the allocation to assets that share similar characteristics as pension plan liabilities. But what is the right composition of liability hedging assets? There is no single answer to this question and more attention is warranted as the liability hedging asset allocation grows.

In general, liability hedging assets have predominantly been invested in investment-grade bonds, with a strong bias to government sectors, notably provincial bonds. Over time, several trends have emerged: 1) the increased adoption of overlay strategies that helped to improve the capital efficiency of plans, 2) increasing emphasis on corporate bonds and certain income-focused alternative assets with a focus on yield enhancement, and 3) the inclusion of annuities as an asset of the plan to support retirees.

The remainder of this paper will explore some of the trade-offs between different options of liability hedging strategies. To make the application concrete and relevant we will focus on the liabilities associated with retirees, which is often thought as a natural area to direct important de-risking actions.

De-Risking the Retirees Through Annuities

Buying annuities allows a DB pension plan to pay a known upfront cost to transfer risk to an insurer. It represents a reasonable anchor to compare alternative strategies.

As plan sponsors rationalize the cost of an annuity purchase, a natural starting point may be to compare the yield implied by the annuity price relative to that offered by a matching portfolio of investment-grade public bonds (i.e., another “low-risk” alternative).

Rate of Return Offered by Annuities

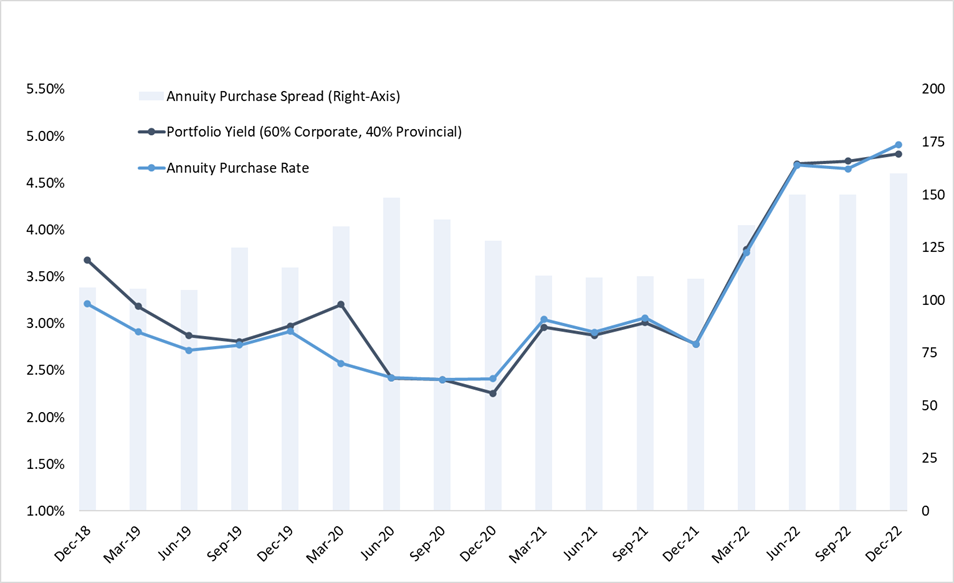

Each quarter, the Canadian Institute Actuaries (CIA) surveys a group of insurance companies to obtain annuity quotes on hypothetical pension groups and supplement this with data on pricing for actual group annuity purchases.

The Annuity Purchase Discount Rate is the unique rate that discounts the projected retiree payment cash flows, based on a set of mortality assumptions prescribed by the CIA, back to the premium amount. The Annuity Purchase Discount Rate is illustrated below, in relation to the yield of a bond portfolio with similar duration:

Historical Yields

Notes: The yield shown is the internal rate of return net of management fees. Annuity purchase discount rates based on CIA guidance for a plan with a duration of 10 years at the end of each quarter. Sources: FTSE, Canadian Institute of Actuaries’ Assumptions for Hypothetical Wind-Up and Solvency Valuation Guidance Notes.

As can be seen on the chart, over the last 4 years, the Annuity Purchase Discount Rate has been broadly aligned with the yield of a liability-matching bond portfolio made up of 60% corporate bonds and 40% provincial bonds.

We encourage plan sponsors to consider a broader set of de-risking investment options and explore ways to reduce de-risking costs without materially compromising risk reduction.

Liability-Driven Investing (LDI) Plus: Revising the Strategic Composition of Liability Hedging Assets to Reduce De-Risking Costs

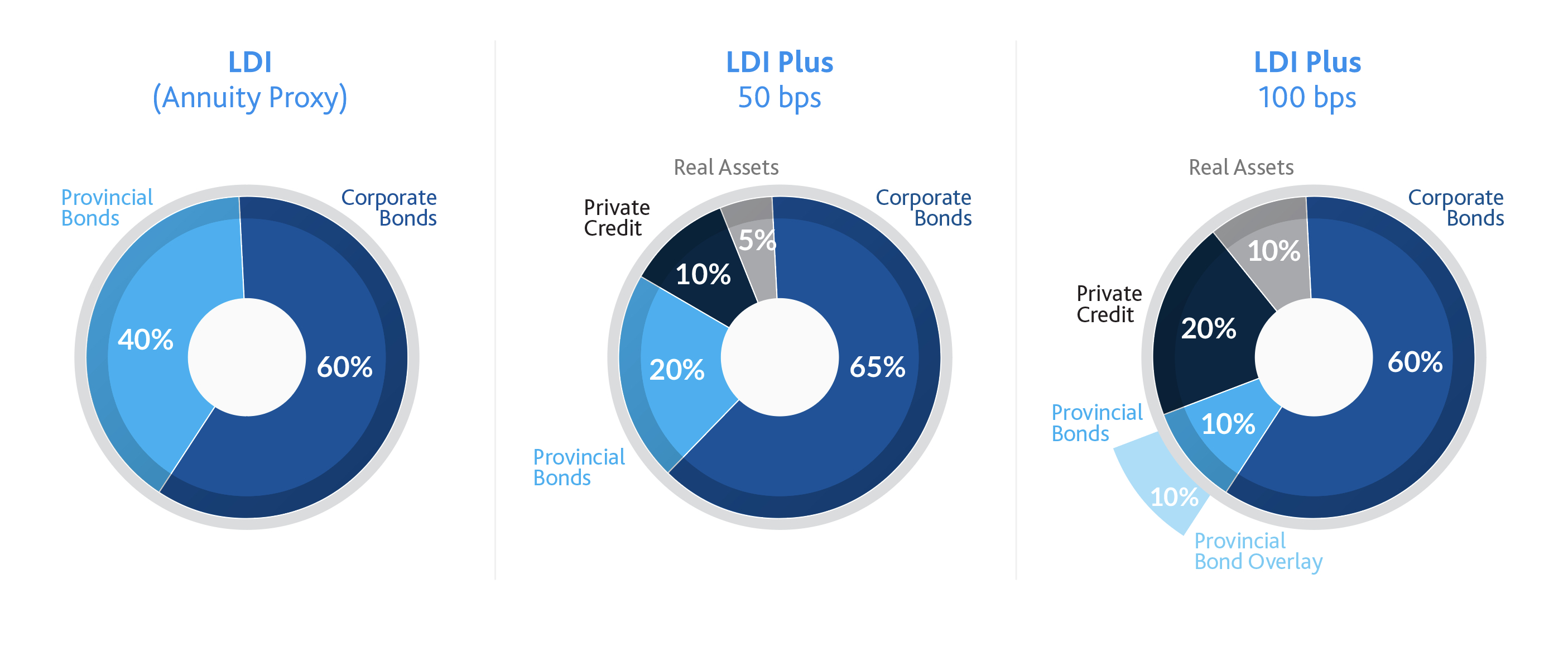

For now, let us assume that a 60% corporate, 40% provincial bond portfolio structured to broadly match the retiree payments is judged to be comparable to an annuity purchase in terms of the rate of return offered and that such an investment is expected to stabilize the funded status.

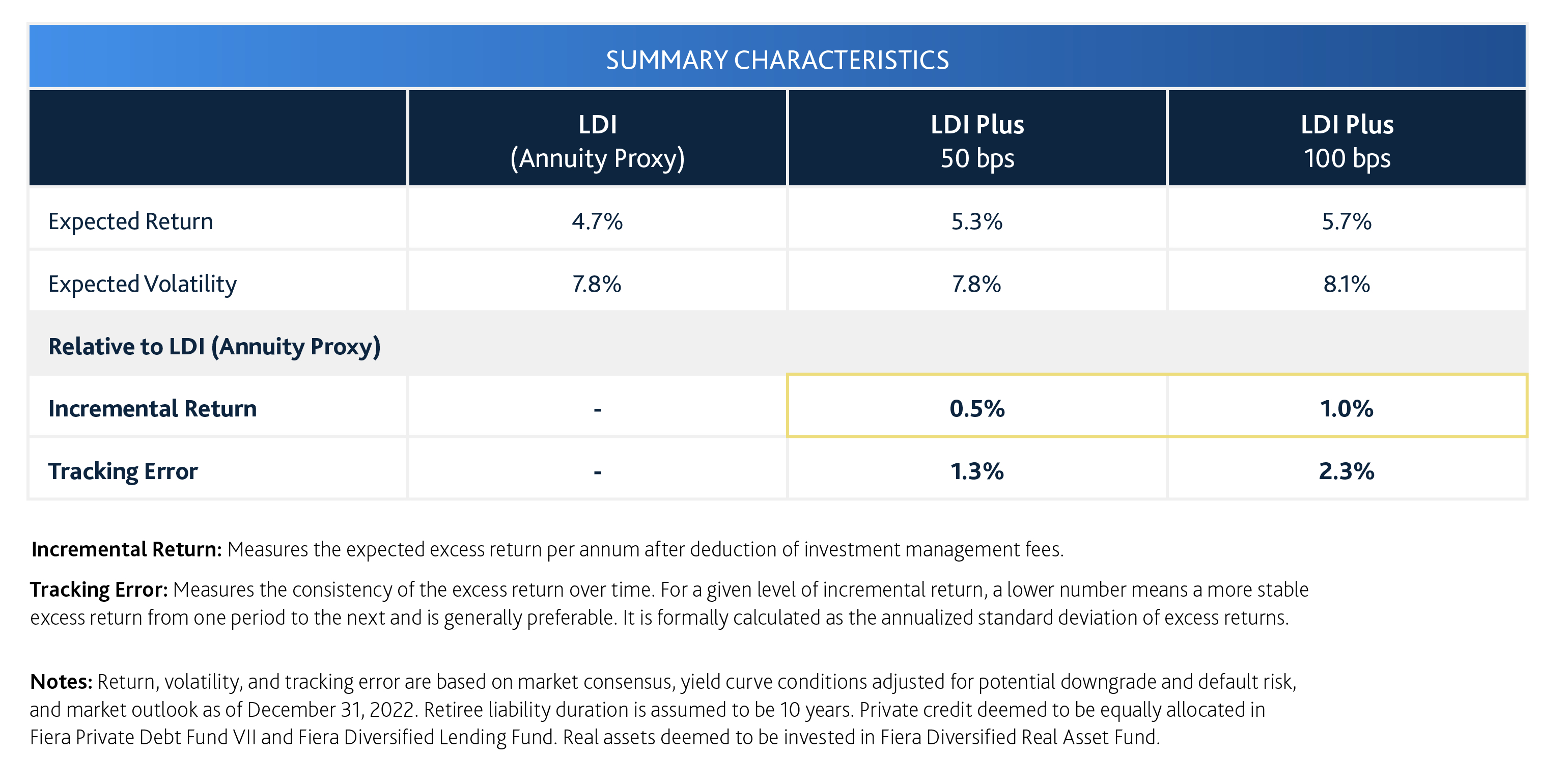

We will now show that it takes tweaks, not an overhaul, to improve the return of such a liability hedging portfolio, to engineer funded status improvements over time. This approach, which we will define as “Liability-Driven Investing (LDI) Plus”, strives to modify the strategic allocation to reduce de-risking costs, without materially compromising the stability of the funded status.

What Strategies Are Legitimate “Plus” Sources?

From the pension plan sponsor’s perspective, the overarching objective is to reduce de-risking costs without compromising the liability hedging benefits. A typical convention for defining the opportunity set is to emphasize strategies that are liability like – those with more predictable cash flows or interest rate hedging benefits. Beyond public bonds, certain private credit and income-focused alternative strategies naturally come to mind. We think the investment opportunity set should be defined based on several considerations: liabilities duration, investment horizon, liquidity needs and impact on the provision for adverse deviations.

Case Study: Is a Liability-Driven Investing (LDI) Plus Approach Worth It?

What does it Take to Enhance Return by 50 or 100 bps per Year?

As of December 31, 2022, an allocation to private credit and/or income-focused real assets of 15 to 30% can help support a potential return enhancement (net of fees) of 50 to 100 bps:

Projection of Funded Status Over Time

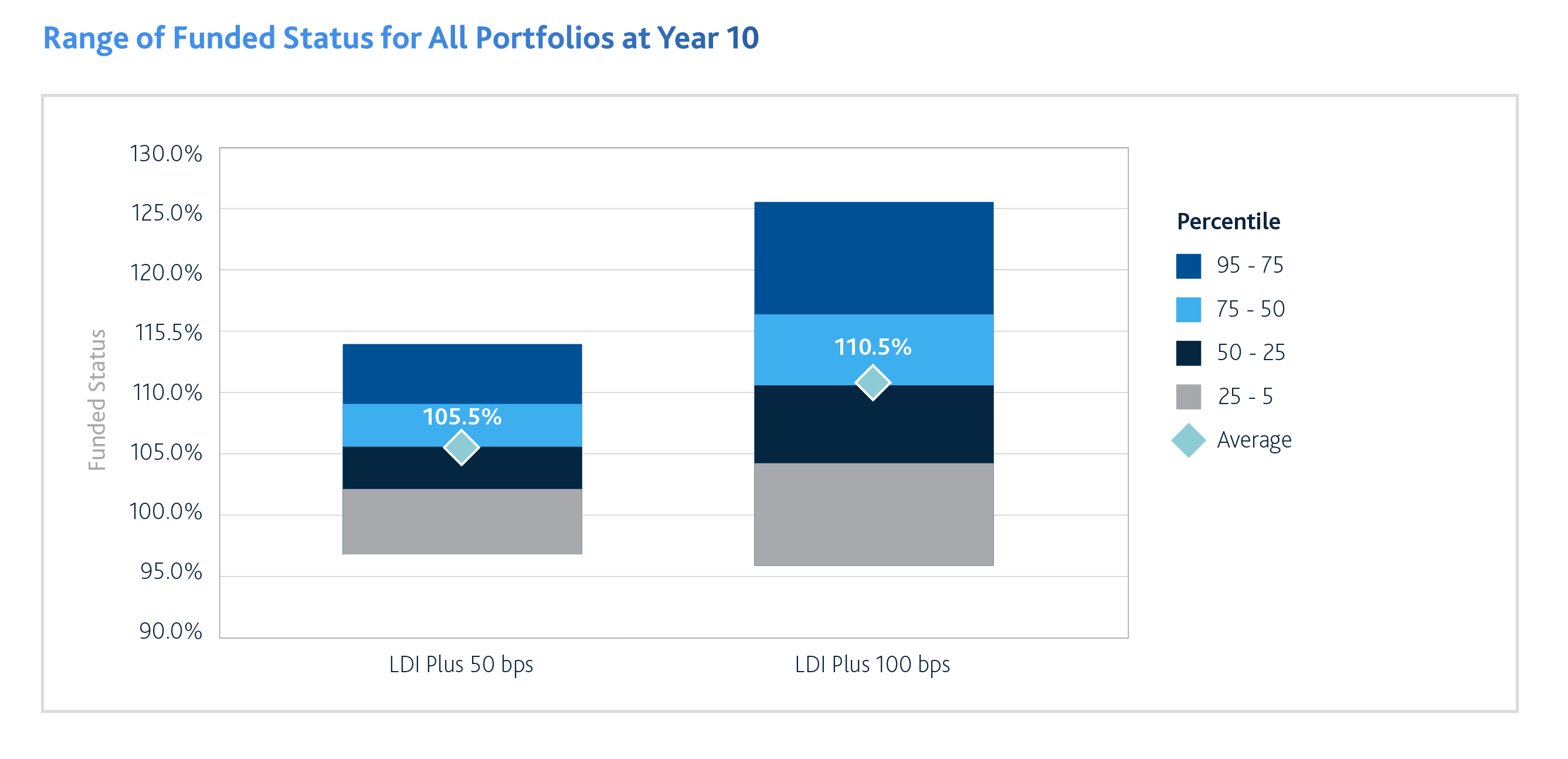

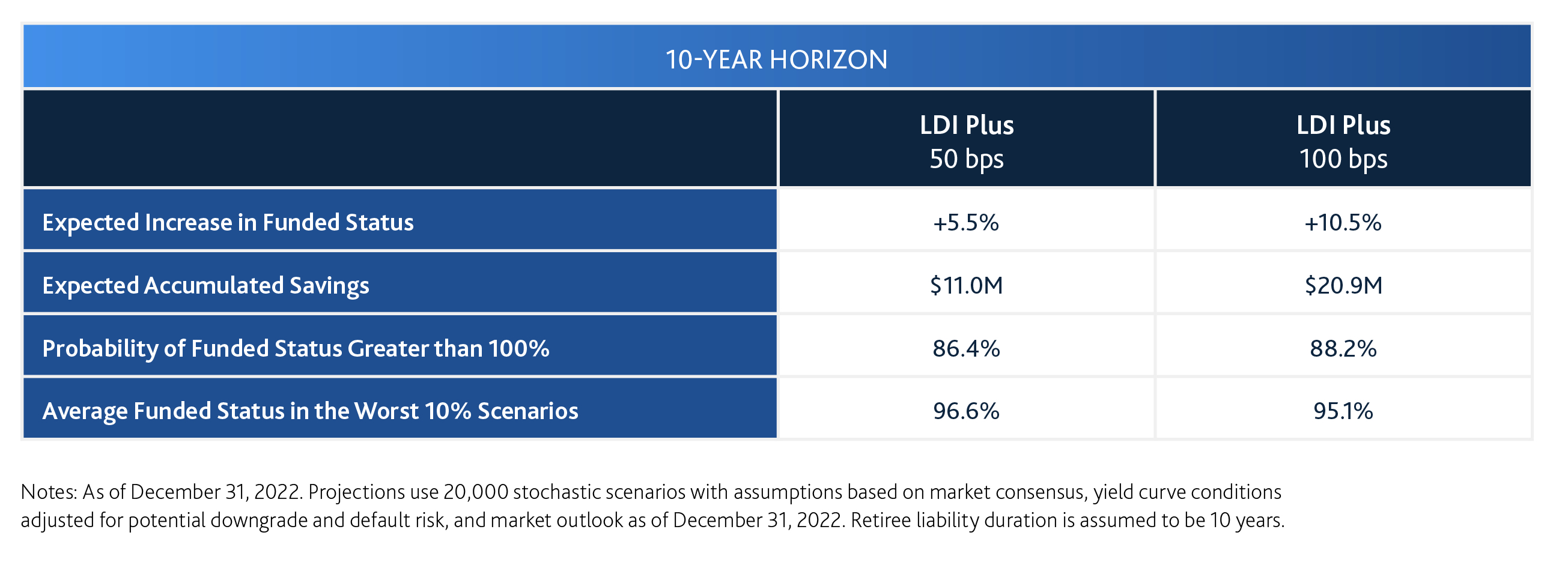

To express the impact of a Liability-Driven Investing (LDI) Plus approach in more tangible terms, we have simulated the distribution of investment outcomes for each portfolio, and translated into Funded Status, starting from an initial investment of $200M and an assumed Funded Status of 100% at the end of December 31, 2022. We have approximated the evolution in the liabilities using the return of a liability matching 60% corporate and 40% provincial bonds portfolio. The distributions of the Funded Status at the end of 10-year horizons are shown below:

Other Benefits of a Liability-Driven Investing (LDI) Plus Approach

Generating an additional return over liabilities, under a tight risk budget, can help to improve funded status outcomes. For some plans, that could mean reducing the time to achieve full funding. For plans that are already well funded, any additional surplus generated over time could be utilized for a number of reasons:

- Allow for ad-hoc benefit improvements (e.g., cost-of-living adjustment to retirees)

- Take contribution holidays

- Pay contributions in the DC component of the plan (as applicable)

Annuities can deliver unique outcomes to plan sponsors. However, there are liability-hedging solutions that support de-risking objectives while retaining flexibility and providing additional benefits across the entire plan.

Bottom Line: Take the Time to Assess Your Options

For pension plans that are in the enviable position to afford some de-risking, there are multiple approaches and options. The breadth of asset classes that are available to pension plans provides an opportunity to implement a thoughtful design. In addition, a favorable funding regulatory framework across most provinces means there are many ways to de-risk retirees at reasonable costs without surrendering the flexibility to adjust the plan’s risk profile in the future. We encourage plan sponsors that want to de-risk to consider a broader range of low-risk investment options, to help answer the question “Now what?”

Claude Lockhead, Principal, Fiera Capital

- Maxime Carrier - Senior Portfolio Manager, Fixed Income Solutions

- Martin Dionne - Vice President, Fixed Income Solutions