Articles of Interest

Managing Pension Portfolio Risks: What Happens if Investors Remove China from Emerging Markets and Global Equity Allocations

Emerging markets equities have long been a component of many pension and retirement portfolio equity allocations as both a diversifier and a return enhancer to developed markets. Within emerging markets, China’s weight has risen significantly since the Global Financial Crisis in 2008, peaking at about 40%. As a result, investors are looking for ways to manage risk of this outsized weight, or even remove Chinese equities, without significantly affecting performance. We analyze China’s impact on emerging markets and global equity allocations, and propose how investors may seek to control China’s influence in their emerging markets equity allocation to better manage risk.

Despite China’s increasingly growing influence within emerging markets, even at the current weighting of 24%, China remains a relatively small piece of the global market, at 3% of the global MSCI All Country World Index (MSCI ACWI IMI). To put that in perspective, Apple represented about 4% of the same index as of December 31. In other words, removing China from the global portfolio is somewhat akin to choosing not to hold the Silicon Valley tech giant. While this may not seem significant, this does introduce meaningful tracking error (difference between the performance of an investment and its benchmark), and a source of risk, relative to the global opportunity set.

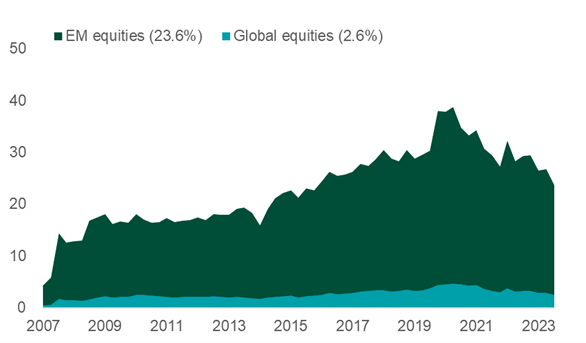

Exhibit 1: China’s weight still relatively small in a global context

China has risen to represent 24% of the MSCI Emerging Markets Index, but it is only 3% of the MSCI ACWI IMI Index.

% WEIGHT OF CHINA WITHIN…

.png)

Index Performance with and Without China

With these index weightings in mind, we compared the performance of the emerging markets and global equity indexes “with China” and “without China”.

As shown in Exhibit 2, here’s what we found:

- The MSCI Emerging Markets Index returned 4.1% annually the past five years with volatility, as measured by standard deviation, of 19.2%. Removing China would have led to a 3.3% higher annualized return with just a 1.4% higher risk.

- At the global level, the differences are less pronounced. The MSCI ACWI IMI Index returned 12.3% annually over the past five years with a risk level of 17.9%. Removing China increased the return by 0.6% and risk by 0.4%.

- Notably, the indexes without China outperformed, because of China’s underperformance during the period as the country’s economy struggles to recover from the pandemic.

Exhibit 2: without China, index risk-return profiles change

While return and risk changed significantly with China in the emerging markets index, the impact was less notable in the broader global index.

5 YEAR ANNUALIZED RETURN & RISK

.png)

Source: Northern Trust Asset Management, Bloomberg. Risk is standard deviation. EM = MSCI Emerging Markets Index. 12/31/2018 – 12/31/2023.

Based on this simple analysis, removing China from the emerging markets index impacted results but made little difference on the global index.

For a more sophisticated view, we further examined China’s exclusion from a few other angles: tracking error, periods of stress, geographic profile and sector profile.

China’s Impact on Tracking Error

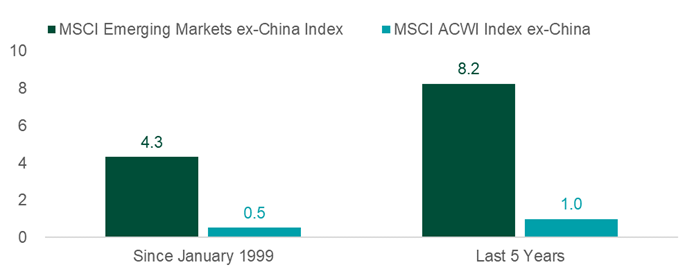

The question of tracking error can be front-of-mind for investors when it comes to managing risk from China equities. Exhibit 3 shows the tracking error of the MSCI Emerging Markets ex-China Index against the broader MSCI Emerging Markets Index, since 1999 and over the last five years.

In any given year, an ex-China emerging markets investment is “likely” to outperform or underperform the MSCI Emerging Markets Index by as much as 8.2%. However, at the global equity portfolio level, removing China becomes much less noticeable, having produced a historical tracking error of 1.0%. This number, although smaller, is still significant for investors whose investment policies may stipulate MSCI ACWI IMI as the performance benchmark in their retirement portfolios.

Exhibit 3: lower global influence on tracking error

While removing China from the MSCI Emerging Markets Index produced significant tracking error given its high weight, the impact on the Global ACWI IMI Index is much smaller since inception and over the last five years.

TRACKING ERROR TO BROAD INDEXES (%)

.png)

Source: Northern Trust Asset Management, Morningstar. Since inception data is from December 31, 1998 to December 31, 2023.

Stress Testing: Mixed Results

Often times, investors want to understand the impact of their decisions during times of market stress, because these are times when even seemingly minor decisions can have an outsized effect.

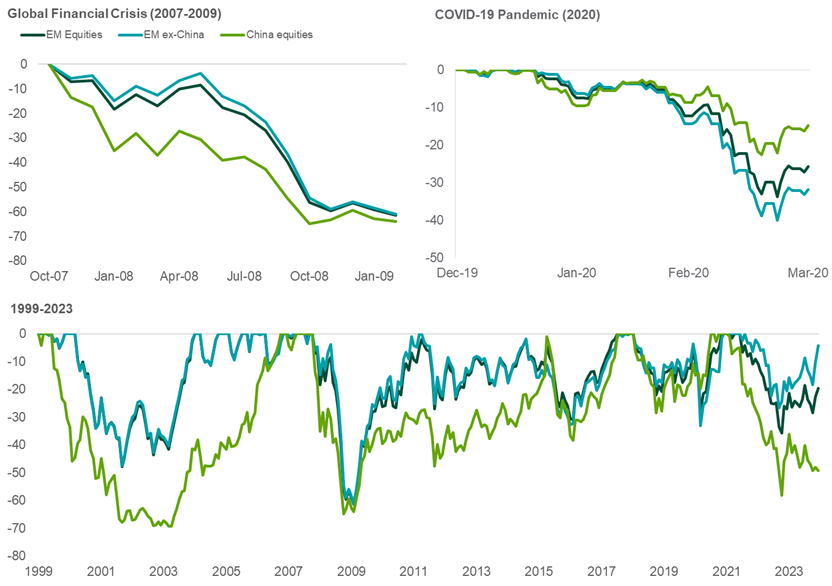

The top charts of Exhibit 4 highlight the performance of Chinese equities and emerging markets equities, both with and without China, during arguably the two most prolific stress periods of the recent past — the Global Financial Crisis and the COVID-19 pandemic.

Exhibit 4: China shows mixed results during recent market shocks

China limited some downside at the onset of the pandemic in 2020, but it fared worse during the Global Financial Crisis from 2007 to 2009. During drawdowns since 1999 (bottom chart), the emerging markets indexes with and without China have performed similarly.

DRAWDOWNS

.png)

Source: Northern Trust Asset Management, Morningstar.

In the bottom chart, we find that China tended to be more susceptible to drawdowns than the full index (expected for a single country versus a more diversified group of countries). Notably, the differences in drawdown between emerging markets equities and emerging markets ex-China are fairly immaterial.

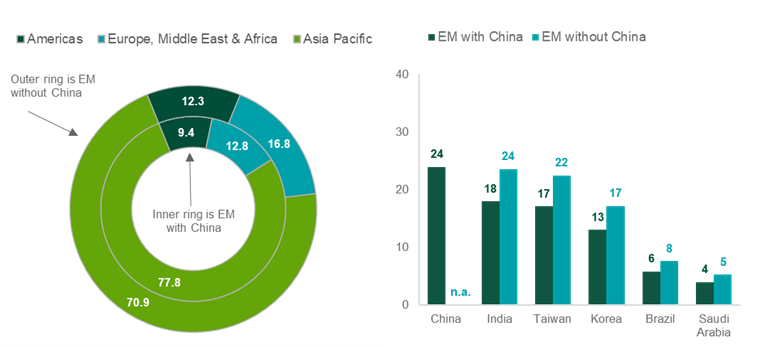

Regional Analysis: Asia-Pacific Remains Influential Without China

The MSCI Emerging Markets Index contains an eye-catching 78% allocation to the Asia-Pacific region, see Exhibit 5. Even when removing China’s 24% weight, Asia-Pacific still represents 71% of the remaining index. Hence, even though investors can remove direct exposure to China within their retirement portfolios, Asia-Pacific’s presence remains strong with influence from the other key countries in the region around China.

Exhibit 5: without China, Asia-Pacific still weighs heavily

Without China, Asia-Pacific countries still would represent 71% of the MSCI Emerging Markets Index.

SUPER REGION WEIGHTS (%) TOP COUNTRIES BY WEIGHT (%)

.png)

Source: Northern Trust Asset Management, Bloomberg. Weights as of December 31, 2023 using IMI indices.

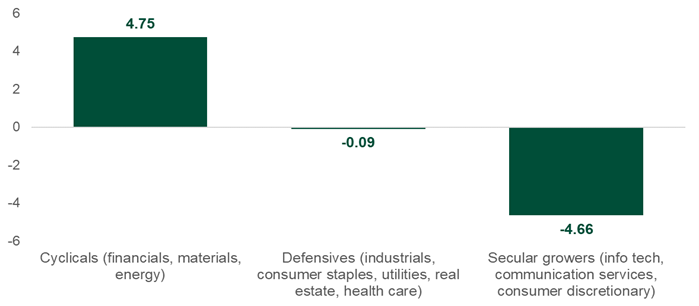

Sector Analysis: A Cyclical Tilt in China

In Exhibit 6, we turn to the sector-level effects of removing China from the MSCI Emerging Markets Index, grouping sectors into three categories:

- Cyclicals: sectors most sensitive to changes in macroeconomic activity

- Secular Growers: growth-oriented sectors riding longer term demand trends

Defensives: sectors showing stability during economic weakness

Exhibit 6: without China, exposure to cyclicals increases

Removing China makes the index more sensitive to cyclical sectors (financials, materials and energy) and less sensitive to secular growers, where decreases to the consumer discretionary (-6.3%) and communication services (-3.9%) sectors offset an increase to the information technology (+5.6%) sector.

RELATIVE SECTOR WEIGTS (EM INDEX EX-CHINA MINUS EM INDEX, %)

.png)

Source: Northern Trust Asset Management, Morningstar. Sector weights as of December 31, 2023.

While we aren’t analyzing the outlooks for these sectors here, we think investors should be mindful of how the change in sector makeup may impact risk and return of their retirement portfolio.

China Exposure: All or Nothing?

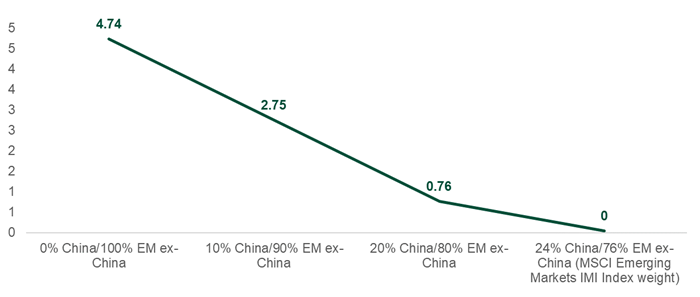

With the possibility that China’s significant weight in the MSCI Emerging Markets Index may grow meaningfully larger in the years to come, investors may want to manage their exposure otherwise dictated by the broader benchmark. To help control this risk, one option for investors is to take a building block approach and create custom weights that suit their needs by investing in MSCI China and MSCI ex-China separately.

Exhibit 7: customizing exposure to China through passive indexes

Rather than removing China, investors can dial down their risk versus the benchmark index through varying portfolios of the MSCI China Index and the MSCI Emerging Markets ex-China Index. Similar to tracking error, active risk for each portfolio represents the amount of risk investors take versus the MSCI Emerging Markets Index, with a higher percentage indicating more risk of underperforming the index.

ACTIVE RISK FOR INCREASING ALLOCATIONS TO CHINA (%)

.png)

Source: Northern Trust Asset Management, FactSet. Data as of December 31, 2023.

Exhibit 7 shows that active risk is neutralized, at zero, at the portfolio comprising a 24% weight for the China index and 76% weight for the emerging markets ex-China index, matching China’s 24% weight in the MSCI Emerging Markets Index.

In contrast, fully excluding China results in an expected active risk of 4.74%, which may not be palatable for benchmark-aware, risk conscious investors. A more modest approach of adjusting the weight of China to, say, 10%, would result in an expected active risk of 2.75%, which may be more acceptable.

Key Considerations for China in Retirement Portfolios

Based on our analysis, removing Chinese equities from a global equity allocation has enough of an impact to results that a thorough understanding is required.

Removing China from the portfolio is significant for emerging markets investors. And although the impact is less prevalent in a global context, it is still not something that can be overlooked.

While some investors may want to remove China altogether, another approach investors can take is to adjust their exposure to China through dedicated MSCI China and MSCI EM-ex China allocations (passive or active).

Ultimately, this is an implementation decision for each investor to make on their own, and the decision depends on risk tolerance of each plan and views on the outlook for China. In our view, investors do not need to accept China’s weight in the index as a given, and there are options available for investors that wish to make adjustments in their retirement portfolios.

Jordan Dekhayser, CFA, Head of Client Portfolio Management (CPM), Northern Trust Asset Management

Jordan Dekhayser, CFA is Head of Client Portfolio Management (CPM) at Northern Trust Asset Management where he oversees a cross-asset class team supporting NTAM’s investment platform. Jordan and the CPM team represent the investment team and are focused on accelerating and facilitating growth and retention by framing portfolio and investment capabilities, contributing to thought leadership and innovation, and representing the “voice of the client”.

Jordan has expertise in Quantitative and Index investing, innovation, portfolio construction, trading, ESG integration, and developing market insights.

Prior to this role, Jordan was a Senior Portfolio Manager and Lead Equity ETF Portfolio Manager where he led a team of portfolio managers responsible for a variety of index-based and quantitative strategies. Before joining Northern Trust in 2008, Jordan worked for Deutsche Bank as a sales-trader for the Global Equity Program Trading team where he covered US institutional clients trading global equities.

Jordan has a Bachelor of Science in Finance from Rutgers University where he graduated in 2003 with Highest Honors.

Jordan is a CFA Charterholder, has his Series 3 license and a certificate in Applied Responsible Investment from the PRI.

Jordan is a member of the CFA Institute and the CFA Society of Chicago.

Jordan is a youth league sports coach for the Northbrook Park District and Northbrook Girls Softball Association.

In his spare time, Jordan enjoys distance running, baseball (more watching than playing!), and reading.