Articles of Interest

Revisiting The Case For Active Portfolio Management

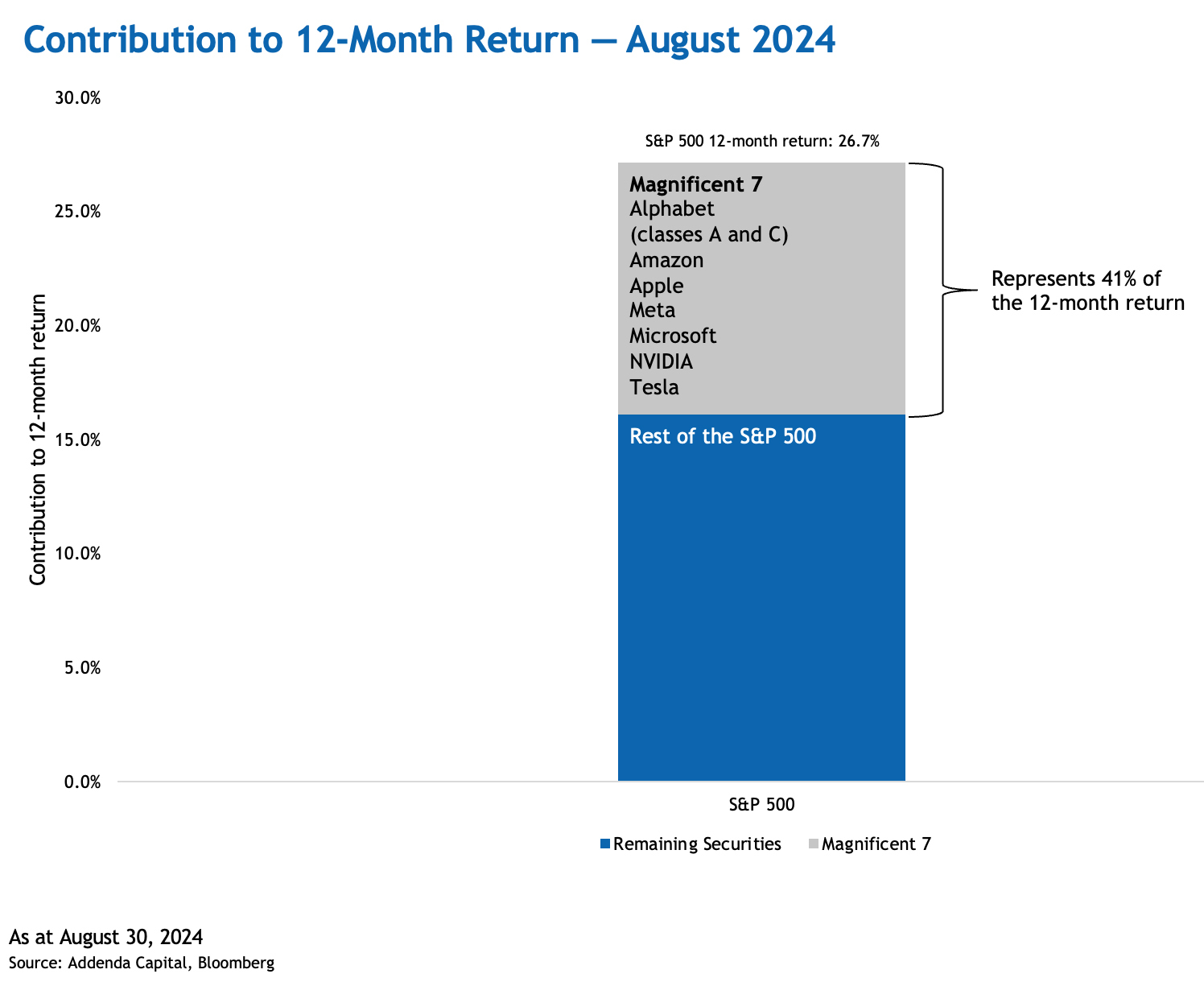

During the 12 months leading to Aug 30, 2024, the S&P 500 returned 26.7%. While this climb has benefitted investors who favour index funds, many have pointed to the fact that 41% of this overall gain has been attributable to the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla). This situation, not without precedents, provides an opportunity to revisit risks of market concentration while taking a fresh look at fundamental aspects of active portfolio management.

The Magnificent Seven represented 35.5% of the S&P 500’s market capitalization at the end of August 2024. However, a recent study conducted by Morgan Stanley noted that the concentration of the U.S. market is actually lower than that of other markets around the world1. It also highlighted that the level of U.S. concentration was only 13% in 2013. This escalation has raised questions, for example about the challenge of surpassing benchmarks, while leading some to speculate about a tech bubble.

When an index’s overall performance is strong, some investors may worry about missing out on opportunities. However, adjustments may be required if market conditions changed and the outlook for the Magnificent Seven became less favourable. Historically, active management has often shown value in this type of situation, particularly during transitions from bull to bear markets.

Risks of Market Concentration

Let’s take a high-level view of three risks of market concentration.

Increased Volatility: When a few large companies have a significant impact on the market, any negative news or performance issues with these companies can lead to greater market volatility.

Reduced Diversification: High market concentration means that investors’ portfolios may be less diversified. This lack of diversification can increase the risk of significant losses if the dominant companies underperform.

Valuation Concerns: Over-reliance on a few high-performing stocks can lead to inflated valuations, which may not be sustainable in the long term.

Navigating bear markets

Active portfolio management requires knowledge about past events. By studying factors that led to these and how things unfolded, investors can work on strategies to help mitigate risks or seize opportunities. Keeping this in mind is crucial in the current market environment, as investors face an uncertain economic backdrop, with central banks adjusting monetary policy to control inflation and slower economic growth.

For those who haven’t experienced a prolonged bear market since entering the financial sector, let’s take a quick look back. After the Internet bubble of 1999-2000 popped, investors who had jumped on the bandwagon were left scratching their heads, wondering how they would manage to bounce back.

In a bearish market, active management allows managers and investors to adjust their strategy, as opposed to a passive approach that aims to mirror index trends. For example, an active approach can seek to reduce exposure to sectors deemed too expensive, while increasing exposure to those where asset prices may be considered undervalued or more reasonable.

In 2008, for example, investors looking for ways to weather the storm opted for companies that have strong financials, a clear and defined strategy, competitive advantages vs peers and a proven track record. These types of companies can better sustain tumultuous times in the market and protect portfolios. A similar approach could be considered for 2024, as investors may look for ways to protect themselves from possible market turbulence. Here are a few basics of active management, even if they may seem obvious to some.

Fundamental Company Analysis

Fundamental company analysis is an important aspect of active management. It consists in examining a company’s financial health and that of its competitors, while considering the macroeconomic and political context.

Financial Health

- For example, the financial analysis of a company enables us to assess its ability to generate profits. Is it liquid? Does it generate cash flow? Does it manage its debt well? And relate this to its share price.

Positioning in relation to competitors

- How does its product offering or strategic plan differ from other companies?

- Does it have a well-established strategy for continued growth? Can its business model survive in the long term?

Quality of its management team

- Is the company’s mission clear?

- What objectives has the team set itself to ensure the company’s growth?

- How many years has the team been in place?

Sector outlook

- Does the company’s sector have compelling growth prospects?

Extra-financial factors

Analysis of environmental, social and governance factors enhances fundamental analysis, seeking to improve long-term performance for investors.

- How are these issues managed by the company?

- What policies have been implemented?

- Is corporate governance robust?

- Are the management team and board of directors well equipped to manage environmental and social issues?

- Are there any specific issues to monitor?

Risk management

Active portfolio management means making the right changes to adapt to new conditions or respond to specific risks. Here are a few elements to consider.

Asset diversification to reduce exposure to certain sectors

- Are there any sectors to which the portfolio is overexposed? Is it technology? Healthcare, such as pharmaceuticals and biotech? Financials? Industrial companies? If so, reducing exposure to reduce risk may be something to consider.

Monitoring portfolio performance

- Does the price of the securities in the portfolio reflect the company’s ability to generate profits? Have there been any changes that should be considered when adjusting the portfolio?

Assessing risks associated with individual securities or sectors

- Do companies face environmental risks that could have a significant financial impact, such as spill risks, risks related to the impact of operations, etc.?

- Are there any social issues to monitor (working conditions, respect for human rights, problems experienced by suppliers, etc.)?

- Are there any governance issues, such as a complacent board of directors, unsustainable practices, or allegations of greenwashing?

Conclusion

The United States’ stock market has performed strongly over the past two years, but given its current level of concentration, now is a good time to revisit the basics of active portfolio management. While index funds certainly have their supporters, one cannot ignore risks associated with such concentration. Active management comes with a strategic framework that helps navigate these risks, leaving room for adjustments to react to changes in the market.

Annie Laliberté, Vice-President, Global Equities

Annie Laliberté leads the Global Equity team at Addenda Capital. She is involved in the management of International, Global, and U.S. equity portfolios. She also analyzes and monitors the various industries and securities held in the portfolios.