Articles of Interest

Scaling New Heights of Responsible Investment Through Governance

In a Mercer survey, Shaping the Future, in June 2023, more than two-thirds of respondents from defined benefit pension plans highlighted the critical role of environmental, social and governance matters in their investment approach. Those surveyed already leverage ESG data when selecting investment managers, monitoring investment activities, measuring progress, and reporting. The next logical step is for plan sponsors to use ESG data to inform the overall governance process.

This step might appear as intimidating as say a first-time hiker tackling a mountain ascent. Fortunately, there is a path. It involves choosing your destination, assembling the right equipment, training, mapping your route and adjusting to unexpected challenges along the way.

Experienced climbers will tell you that preparation is a critical stage – and one that requires a thoughtful approach.

Which peak are you aiming to conquer?

Governing bodies of pension plans set strategic direction, investment policy and expectations. They rely on service providers, including investment agents, to execute the directions. In our context, the governing body is the board of trustees, for the remainder of the article the term board will be used.

To define a destination the board needs to consider all relevant factors and risks as part of its fiduciary duty. This includes analyzing risk in the short and long term and taking appropriate steps to limit certain exposures or capitalize on investment opportunities. There are different types of risk including market volatility, currency and climate change.

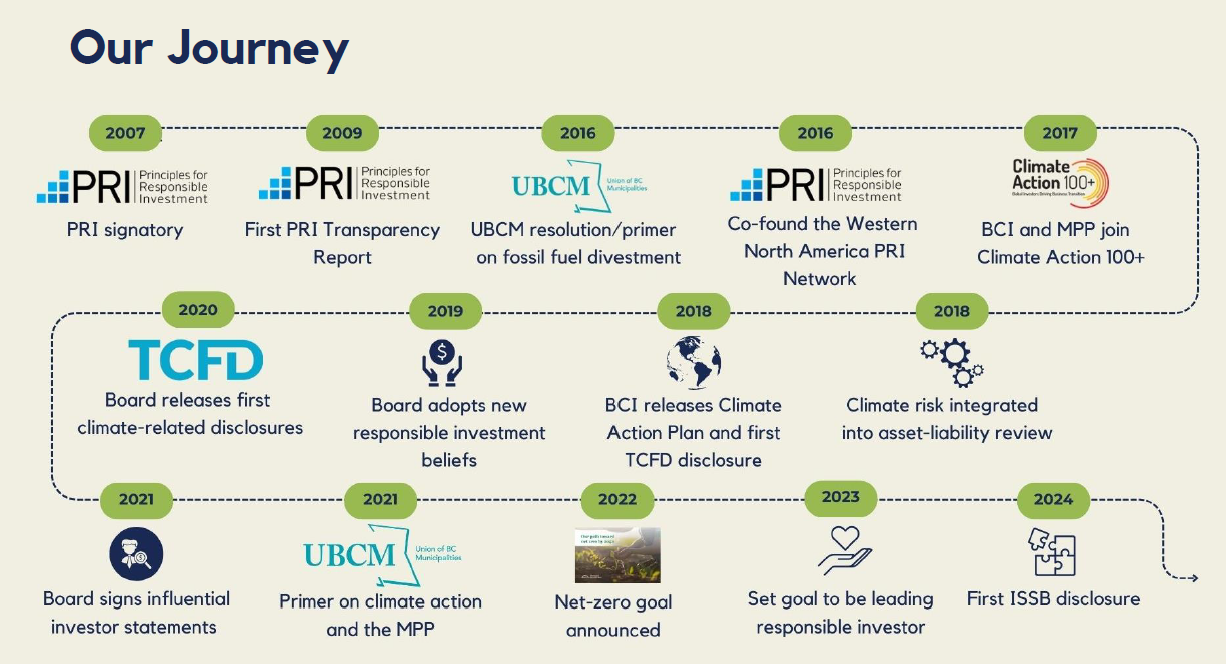

For the Municipal Pension Plan, we consider those factors as part of strategic planning. With responsible investing as a strategic objective, we took early steps to incorporate ESG as part of our governance framework to climbing our own mountain toward tangible climate-related goals. Fifteen years from our first step of becoming a PRI signatory to announcing our net-zero goal, we can look back to see how the steps unfolded. As a critical governance document, the board’s strategic plan moved us along the journey and helped us refine and articulate our destination.

“Although you don’t manage the fund on a day-to-day basis, you do determine the key strategic priorities for the fund … only the trustees can establish it as the roadmap for the fund.” CFA Institute Research Foundation, A Primer for Investment Trustees, page 5 (https://www.cfainstitute.org/-/media/documents/book/rf-publication/2017/rf-v2017-n3-1.ashx)

Getting started: Equipment for the journey

Our first concrete step toward integrating ESG into governance policies was to become a signatory to the Principles for Responsible Investment in 2007. We submitted our first transparency report in 2009.

Education

A foundational element was a commitment to educating ourselves on climate change and action, both at a committee and board level.

Topics included understanding climate science, how climate change may impact the portfolio, and the relationship between fiduciary duty and climate risk. Our investment committee also considered the impact of an inevitable policy response to climate change.

From the beginning, ongoing education on this fast-evolving issue has given us common ground for meaningful discussions that have shaped decisions and policy.

It takes discipline to prepare a relevant and meaningful curriculum. It takes commitment to prioritize the space and time on agendas over several years. Having a shared curriculum leads to richer discussions about critical issues.

Collaboration

It’s good to have partners on the journey. Collaborations, partnerships and networking can be invaluable tools in a board’s development.

In our case, we identified organizations that would both deepen our education and through which we could express our voice about ESG-related investment matters.

Through our relationship with PRI, the Municipal Pension Plan co-founded the Western North America PRI Network. This was a valuable networking and relationship building move. Our investment committee chair remained involved throughout the network’s development.

We joined Climate Action 100+ to provide our support to this premier investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take appropriate action on climate change.

The board is an affiliate member of SHARE, a leading not-for-profit organization in responsible investment services, research and education. SHARE supports institutional investors to become active owners and develop and implement responsible investment policies and practices.

We also added our voice to advocacy letters on topics such as global investor statements, methane regulations, risk management guidelines and sustainability standard guidelines. Discussions about these topics enriched the board’s understanding of ESG-related issues and were an exercise in putting our developing knowledge and principles into practice.

As a board, it can be helpful to consider:

- What collaborations would support the board’s learning?

- Where can the board’s expertise or voice have the most impact?

- What actions will assist the board in mitigating risks in its current environment?

Training for the big climb

The next stage is to put theory and learning into practice. This stage can include hiring a guide or trainer, building ESG governance muscle and sharing results of your training.

The Municipal Pension Plan engaged a responsible investment advisor to assist the board in its ESG integration. Working with a responsible investment consultant gave us an outsider’s perspective, making sure we were taking as much of a 360 degree view as possible. This has provided valuable touchpoints for the board along the way.

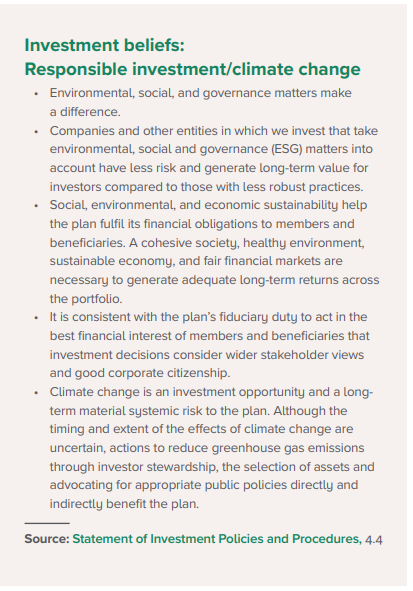

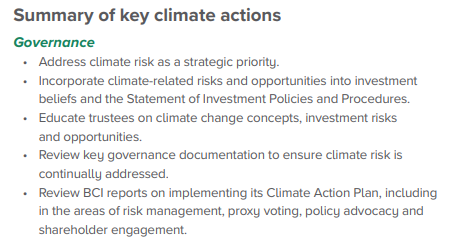

We built muscle by incorporating climate risk scenarios into our asset liability modelling review and adopting new responsible investment beliefs in the Statement of Investment Policies and Procedures.

We shared results by developing a responsible investment strategy and including climate-related financial disclosures in the plan’s Annual Report.

Together these activities provide an opportunity to

- Help members understand the importance of plan investments to their pension and how plan investments work

- Provide information about how the plan is approaching climate-related investments

- Be transparent in investment philosophy and strategy to the extent possible

- Position the plan as a leader in responsible investing and voice for positive change in the capital markets

Mapping your route

With a destination in mind, the right equipment and training, it’s time to map your route.

In 2020, the Municipal Pension Board of Trustees approved a three-year strategic plan, prioritizing addressing climate risk to the investment portfolio. We committed to explore investing in a manner compatible with the Paris Agreement goal of keeping the global average temperature to well below 2 ºC above pre-industrial levels, and to study the potential impacts of a sudden significant policy response.

This involved requesting information and briefing notes from our investment agent on topics such as engagement and divestment, and measuring the investment agent’s progress on climate action. We also considered advice from our administrative agent on communications implications and reputational risks of making a commitment or not making one.

During this period, we also collaborated with one of the plan partners on a policy paper that explored opportunities for climate action, including an exploration of a net-zero commitment.

All of this resulted in a revised climate change investment belief in our Statement of Investment Policy and Procedures that led to our decision to make a net-zero goal.

Getting to your destination

Here’s where governance documents come together, with board strategy becoming policy as it is articulated in governance documents like the SIPP.

We set a precedent of using the SIPP to express our views about responsible investing. This forges a clear trail to follow when issues arise. With support from our investment manager, ESG advisor, legal counsel and other experts, our board considers the impact of ESG matters including climate change on the portfolio. This allows us to assess what are the appropriate steps for the board to take. We use this process to understand the issue and how it affects investments, articulate it in the SIPP and then express it to members and the public.

We may have diversions (planned or otherwise) on our way to our destination, but we believe the policy and process we’ve put in place allows us to be nimble and successfully adjust our route.

The view from the top

Summiting the mountain is not the end, it is an opportunity for a better view of the landscape.

This view enabled us to develop a framework that enhances our governance and helps us fulfil our fiduciary duty. We believe incorporating responsible investing information in policy is a commitment to transparency. It gives members, agents, service providers and other interested parties visibility into our practices.

For the Municipal Pension Plan, it is also a way we express our leadership in responsible investing by making it available to other pension plans who are climbing mountains of their own.

Chelsea Kittleson, Executive Director, BC Municipal Pension Plan

.jpg)

Chelsea Kittleson has been the executive director of BC’s Municipal Pension Plan since November 2023. In her role, she ensures the implementation of the board of trustees strategic plan, oversees the office that supports the MPP’s board and acts as the board’s primary liaison to the plan’s agents and service providers. She has used her investment and operations background to implement and oversee a three-year strategic plan that includes long-term sustainable investment goals.

Previously Chelsea was director of client relations at BCI (British Columbia Investment Management Corporation). Prior to joining BCI, she worked in the capital markets, including as director at CIBC World Markets, and led financing and investor relations at British Columbia Ferry Services Inc. She has a Bachelor of Commerce and holds the Chartered Financial Analyst (CFA) designation. She recently completed her MBA at the Smith School of Business at Queen’s University.