Articles of Interest

Shift work: the art of decumulation planning

Retirement is often portrayed as a golden era of leisure and fulfillment, offering new opportunities for personal growth and enjoyment. However, for many, this significant life transition also brings important financial considerations. As millions of workers approach this pivotal life stage, the challenge of converting a lifetime of savings into sustainable income looms large. This shift from building wealth to decumulation requires a new mindset and strategic planning to ensure retirees can enjoy the fruits of their labour without the fear of outliving their resources.

The shift

Think of the changes a new retiree faces after leaving their workplace. They no longer have a steady paycheque, a workplace social network or the purpose that work can bring. To cover expenses, they must pivot and start spending the money they’ve saved for decades.

These are monumental shifts in a person’s life. And they need to reflect this “shift work” in their life and decumulation planning.

Sun Life research shows that this is a challenge for many. While 63% of plan members are invested in target date funds, a majority mistakenly believe these funds provide a guaranteed income in retirement1. Only 19% are interested in guaranteed products which lock in their savings.2 While 24% are unsure about how much they should annually withdraw in retirement.3

Feedback from sponsors has shown a strong belief in the value of engaging and educating members. By collaborating, plan sponsors and providers can help members make this shift successful.

We believe there are three actions needed to make this happen:

- Engage and educate early – and throughout a plan member’s career. Engage plan members early about how to save and invest successfully and mitigate the financial risks down the road. And manage their expectations along the way.

- Provide one-to-one advice. Support them with professional financial planning advice at every career stage – and post-retirement.

- Offer a range of decumulation options – and continue to innovate. As a member approaches retirement, we need to educate them on their choices and help them understand how to generate the sustainable income they need. A spectrum of solutions should be offered to meet the individual needs of members, while continuing to innovate to fill gaps in the decumulation spectrum.

Here’s a more detailed look at these three pillars of decumulation success.

Engage and educate

A young plan member starting their career is unlikely to make retirement planning a high priority. But this is an ideal time to plant the seeds for the path that lies ahead.

It starts with the foundation – ensuring a plan member joins their workplace plan and begins making contributions. But we should also focus additional support on ongoing digital engagement through easy-to-use, robust planning tools.

These tools can bring retirement planning to life – and they have a powerful, positive impact on retirement savings. Digitally engaged plan members have an average account balance 177% higher than those who aren’t digitally engaged.4 Plan members can see that their actions today have a profound impact on their finances later. And they act accordingly.

Recent revisions to CAPSA guidelines are in line with this approach. A recent modernization of Guideline No. 3 notes that capital accumulation plans are to provide planning tools which assist members in estimating their potential income, living and lifestyle expenses in retirement.5

Planning can be hard – an early start makes it easy

Sun Life and the Canadian Association of Retired Persons (CARP) recently collaborated on a survey of more than 3,500 Canadians. We undertook this research to learn about the retirement perspectives and experiences of both retirees and not-yet-retired individuals.

One-third of all respondents said they did not find it easy to plan for retirement. And the largest cohort didn’t start planning until their 40s and 50s. About 20% of respondents said that they didn’t make an intentional plan to retire at all.

By engaging with plan members early, we provide them with a head start on a potentially difficult process.

Provide one-to-one advice – even in retirement

Personal advice from a licensed financial planner can benefit plan members at any career stage. That’s why making access to advice through a workplace plan is so important.

In the early career stage, plan members may need help balancing several financial demands. In addition to retirement savings, these might include buying a home or saving for a child’s education.

As their career progresses, retirement planning becomes increasingly front and centre. And many need help.

In our research with CARP:

- Half of respondents knew where to find good information about retirement

- Half of respondents felt confident in their retirement plan

- Only 1/3 of respondents said they felt excited about their retirement and what’s to come.

Gender also played a role. Female respondents reported feeling more concerned and less optimistic than men about the retirement experience.

Professional advice can be critical: providing easy access to this through a group plan can ensure more plan members take advantage of it.

This includes the post-retirement years, where life circumstances can change quickly. These changes could include health challenges, financial support for a family member or unexpected home expenses.

Among retirees:

- 43% were worried about outliving their savings.

- 65% said the rising cost of living had negatively impacted their retirement income.

- 45% said their retirement lifestyle was different than they thought it would be.

An advisor can help a retired plan member adjust their retirement income strategy to meet evolving needs. This can be especially important given the impact of cognitive decline. Approximately 15% of individuals over 60 have mild cognitive impairment and will increasingly struggle to make retirement income decisions.6

Offer a range of decumulation options

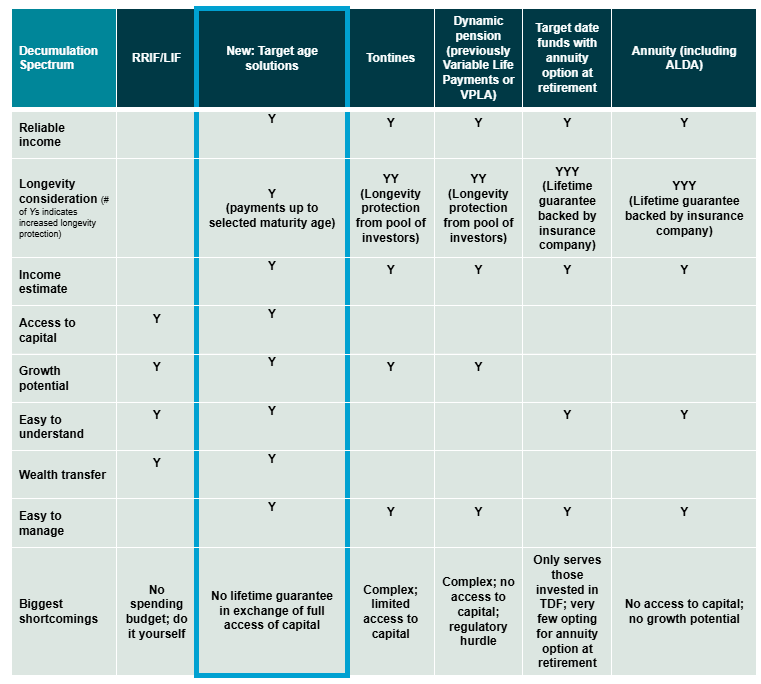

The final pillar in supporting plan members in their shift to decumulation is offering a range of income solutions. No single solution will meet every decumulation need. And many plan members will need two or more solutions in retirement.

Most Canadians want reliable income, flexibility, and simplicity in their retirement products. Yet there are no solutions that combine these three benefits in one option.

For example, an annuity provides predictable income for life and is easy to understand. But it offers no flexibility to make additional withdrawals or to grow your savings. And while a LIF/RIF provides this flexibility, money may run out before a retiree expects, even with an investment professional’s help.

The right product balance will differ for everyone. Educating plan members on available solutions, and providing easy access to them, helps ensure they achieve the right balance.

Emerging innovations

In addition to products like LIF/RIFs and annuities, there are other income solutions that are awaiting widespread legislative approvals. These include Variable Payment Life Annuities (Dynamic Pensions) and Advanced Life Deferred Annuities. While these help address some of the gaps in current income solutions, they are not yet widely available.

Across the globe, specifically in the US and Australia, there are growing examples of defined contribution decumulation models. Simplicity is key. The easier an offering is to understand, the higher the uptake by plan members. With the gap in today’s decumulation solution spectrum, there is opportunity for innovation, providing plan members with simple automated solutions that offer reliable income, access to money, growth potential, and easy wealth transfer.

Target age solution

Target date funds were created to automate and simplify the investment decision during the accumulation phase. This simplicity is driven by a single input: a target retirement year.

A target age solution aims to replicate this automation in the decumulation journey.

Just as target date funds simplified accumulation, a target age solution automates the decumulation journey. The single input in this case: A target age until which a member will receive regular income.

No single income strategy will fit the diverse needs of Canadian retirees. Continued innovation by providers is essential to expand the share of Canadians achieving a dignified retirement.

Embracing the shift – and the decumulation challenge

The transition from accumulation to decumulation is a pivotal moment in a plan member’s financial journey. The three pillars discussed – engagement, advice, and a range of solutions – form the foundation of successful decumulation planning.

We have a unique opportunity to guide retirees through this complex landscape. By addressing the financial risks, managing expectations, and providing continuous support, plan providers can help alleviate the anxiety many Canadians face when planning for retirement.

And by embracing innovative decumulation solutions, we can ensure that plan members thrive in their golden years. Let's commit to making the decumulation journey as rewarding and secure as possible for the Canadians we serve.

1 Sun Life internal survey and data.

2 Ibid

3 2024 Canadian Association of Retired Persons (CARP) and Sun Life survey of 3,500 Canadians.

4 Designed for Savings: Digital Engagement 2024. Sun life

5 Guideline No. 3, Guideline for Capital Accumulation Plans, Sept. 9, 2024. Canadian Association of Pension Supervisory Authorities

6 More Than Normal Aging: Understanding Mild Cognitive Impairment. Alzheimer’s Association, 2022.

Jean-Michel Lavoie

Vice-President, Strategy & Market Development, Group Retirement Services, Sun Life

Jean-Michel Lavoie is the Vice-President, Strategy & Market Development for Group Retirement Services at Sun Life since August 2022. He is responsible for developing and implementing business strategies across Group Retirement Services nationwide, aligning savings and retirement services with Sun Life Canada's offerings. Jean-Michel leads digital transformation efforts and oversees various aspects of the business including strategy, products, partnerships, and marketing.

Jean-Michel is active in the community, serving as Chairman of the Board of the McCord Museum Foundation and on the honorary committee for the Lobster Lunch event. He has been recognized as one of LIMRA's 25 Rising Stars of Innovation and included in the Journal de l'assurance's list of 25 New Leaders in Insurance.

He holds an MBA in management from McGill University and a bachelor's degree in pharmacy from the Université de Montréal.

Anne Meloche, FSA, FCIA, Head of Institutional Business, Sun Life Global Investments

.jpg)

As Head of Institutional Business for Sun Life Global Investments (SLGI), Anne is responsible for developing the strategy for our institutional business, including the go-to-market approach, Client service and product offering. Anne also leads the national institutional sales team, who works with plan sponsors, consultants and advisors to educate and promote SLGI's innovative solutions for group retirement platforms.

Anne joined Sun Life Global Investments in 2012, advancing through a number of senior positions. She has been responsible for building and growing our institutional business in Quebec and Atlantic Canada, and leading our business development and client servicing nationally.

Anne holds a Bachelor of Mathematics from Concordia University and is a Fellow of the Society of Actuaries and a Fellow of the Canadian Institute of Actuaries. She has been a member of the Benefits Canada Pension/Investments Board since 2020 and sits on the Board of Director of the Quebec Breast Cancer Foundation (rubanrose.org).