Articles of Interest

Unpacking the CIA's New Mortality Improvements Scale (CanMI-2024)

The recently released Report to the CIA’s Project Oversight Group on Mortality Improvements Research (the “report”) represents the CIA’s first comprehensive review of mortality improvements (MI) in Canada since 2017. It explores different models for projecting mortality improvements into the future and different approaches for using historical calibration data. Accompanying the research paper, is a calibrated improvements model known as CanMI-2024. While the report does not make any explicit recommendations for the use of the model, the CIA’s stated desire of harmonizing MI assumptions across pension and insurance disciplines means that we expect the CanMI-2024 scale will soon be incorporated into accepted actuarial practice. We note that the current model raises some technical concerns, most notably a lack of smoothing that introduces some strange edge effects, that we assume will be addressed in time. The research also raises some questions around the level of adjustments and discretion allowed for in implementation that we will explore in more detail here.

Key highlights of the report and the CanMI-2024 scale:

- The primary data source used was the Human Mortality Database. This data was supplemented and cross referenced with data from the Canada Pension Plan, Quebec Pension Plan and Old Age Security.

- The researchers considered multiple time periods, ultimately basing both the near-term projections and derivations of ultimate rates in the improvement scales on data from 1980 through 2019.

- The new MI scales are based on methodology that builds upon that used by the UK’s Institute and Faculty of Actuaries’ Continuous Mortality Investigation (CMI) in developing MI tables in the UK. Chosen from among fourteen different methods considered, the methodology combines both deterministic and stochastic methods and differs from that used to construct CPM-B and MI-2017.

- The intent, similar to common practices in the UK and US, is to regularly update near term improvement rates used in actuarial valuations to reflect emerging data.

- For plan sponsors using CPM-B, pensioner liabilities would be expected to increase between 1.5% and 3.5% for men and 1.5% and 2.5% for females (vs approximately 0.5% when moving from CPM-B to MI-2017).

- The CanMI-2024 scale assumes a fixed ultimate MI rate of 1.3% per annum, higher than both the 0.8% p.a. assumed in CPM-B and the 1.0% in MI-2017. The 1.3% sits within a range of reasonable values identified by a stochastic analysis.

- The new MI rates were not subject to smoothing, which introduces some edge effects into the model, especially at younger ages. We have not yet heard of intent to provide a scale with smoothed rates, but we would be surprised if this does not happen.

- The model has not yet been back tested using defined benefit (DB) nor insured Canadian population data.

What issues should pension actuaries and the CIA consider when implementing CanMI-2024?

Predicting future mortality improvements is difficult and requires professional judgement; there may be a range of appropriate assumptions and those assumptions may differ in different situations. The report’s “Outlook” section recognizes that there are many additional considerations that warrant scrutiny prior to formalizing guidance for the use of CanMI-2024. We will explore some of the key considerations below. We believe these key considerations point to the need for flexibility in the implementation of CanMI-2024. This would allow actuaries to use their judgement to ensure its application is appropriate to the population they are modeling as well as the actuary’s future outlook.

Analysis of drivers behind MI

The improvements in longevity experienced by Canadians over the past 100 years have been remarkable. Looking back, we can isolate several major causes for these improvements – for example the decline in smoking has led to a marked decrease in premature deaths due to circulatory system issues. With smoking rates among Canadians, especially younger cohorts, now very low, we shouldn’t expect further reductions in mortality due to smoking cessation (at least not to the same degree). If someone doesn’t smoke, they can’t give up smoking!

The model set forth in the report uses historical data (from 1980-2019) for the Canadian population in two different ways:

- Using a regression approach to project near term mortality improvement rates;

- Using time series to calibrate an ultimate sustainable long-term rate of mortality improvement.

In both applications, it makes the implicit assumption that the rate of change in mortality rates witnessed in the past (i.e. between 1980-2019) is representative of how mortality will change in the future. The report does not focus on the justification for this assumption, but it is important to consider. Further, justification for using this calibration period may be different for near term improvement rates than for long term sustainable improvement rates.

For near term rates, it is easier to justify a continuation of recent trends; causes of recent trends may well continue to have an effect for several years. However, we should still be careful to understand how different populations may have experienced recent trends in different ways and monitor any emerging drivers of change that may not have featured in recent data.

Long term rates are much more subjective. It is not clear that historical improvement rates are necessarily representative of the long-term future. Historical drivers of change cannot always continue indefinitely. Whereas long term historical improvements may give us a useful benchmark, it may be more appropriate to base long-term projected improvement rates on an expert driven factor-based analysis or scenario analysis, rather than assuming a direct replication of what happened in the past.

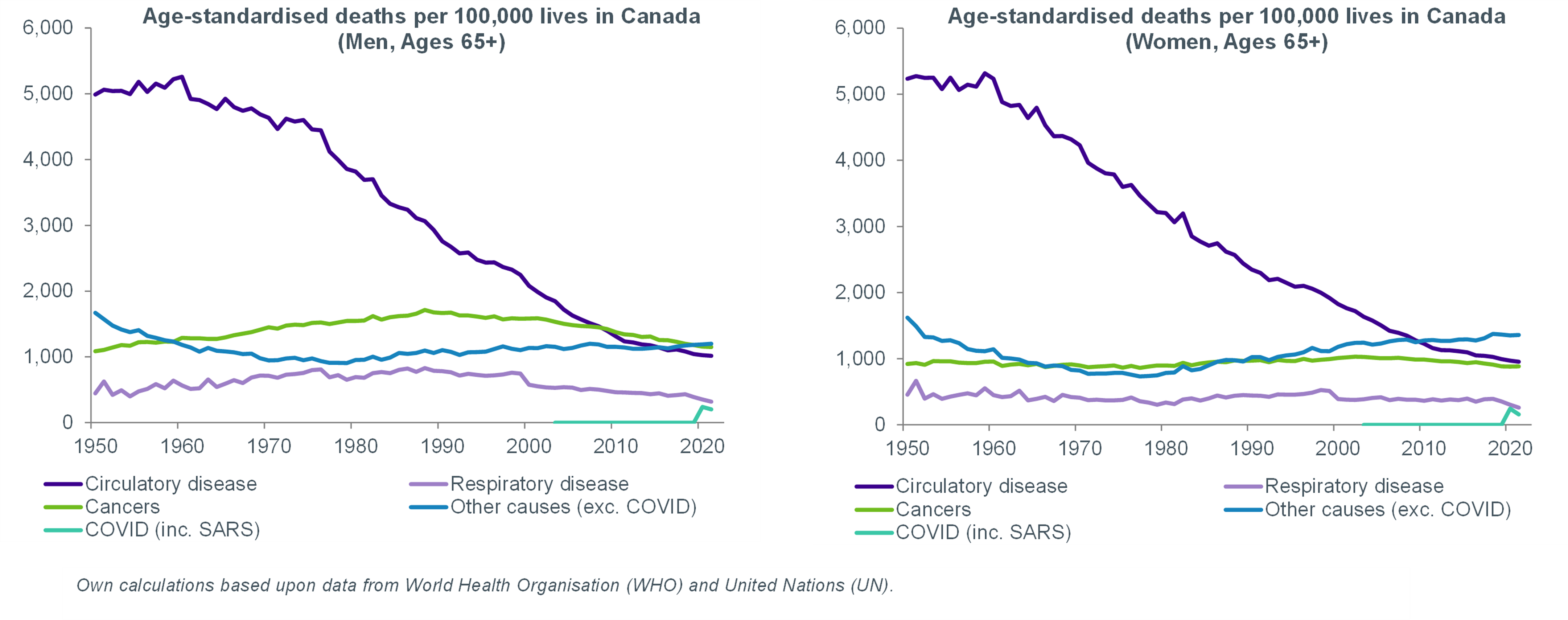

The following charts show trends in past improvements by illustrating how different causes of death have contributed to overall mortality trends over time. Note the sharp decrease in circulatory disease related deaths between 1980 and 2010. Given that you cannot cure the same disease twice, is this trend likely to continue in the future?

Impact of socio-economic factors

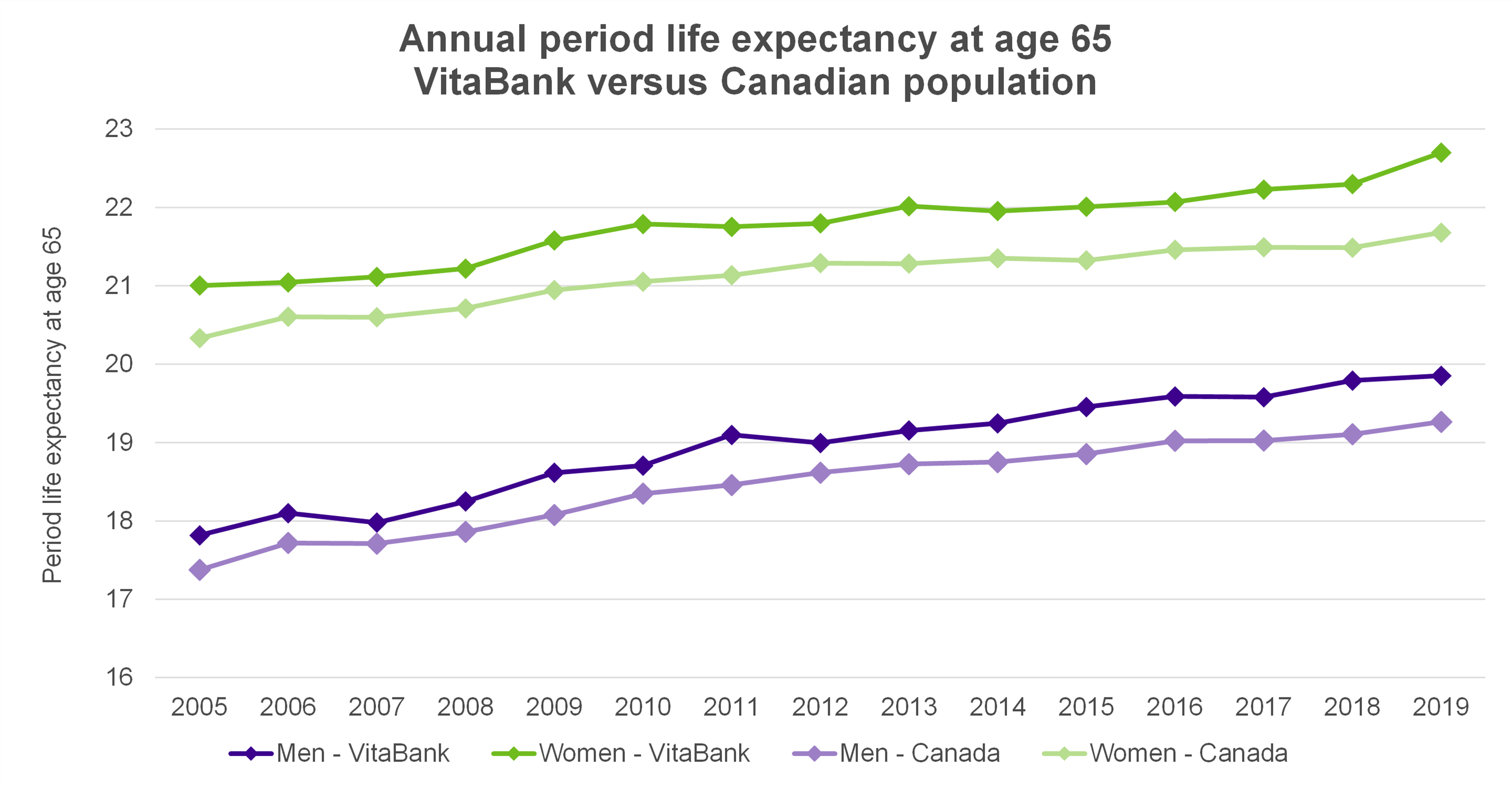

Both population level data and pension plan data show evidence that not only is life expectancy positively correlated with socio-economic status, but also that the range of outcomes is diverging. Longer life expectancies and higher levels of recent improvements are generally observed in higher socio-economic groups and in the insured population (including DB pensioners) compared to the general population. The chart below bears this out and shows that period life expectancy in Club Vita’s VitaBank of DB pensioner data has consistently exceeded that of the general population.

It is important to consider whether population level data is appropriate for projecting mortality improvements for the DB and Insured populations, or whether improvements need to be adjusted before applying to this population.

Implications of COVID-19

Although most health agencies have declared the pandemic over, there is little doubt that the lingering effects of the pandemic continue to drive today’s excess mortality in emerging Canadian population data.

The model set forth in the report is calibrated to pre-pandemic data, and gives no flexibility to the user to reflect any changes to their future outlook on mortality improvements as a result of the COVID-19 pandemic. Given emerging data, it appears improbable that COVID will have no impact on mortality. At a minimum, there will likely be a short-term effect that may necessitate adjustments to either the baseline assumption and/or the improvements assumption. Actuaries should proceed with caution and consider the following key elements:

- COVID-19 has not affected all population subgroups equally. Emerging data highlights differences based on age, gender, geography and socio-economic factors. Understanding how these disparities might evolve and their short and long-term implications for a pension plan is crucial. For example, Club Vita’s data set revealed an insulation effect of the DB population in 2020, with around 1% excess mortality for males and 4% for females – both significantly lower than the population levels of excess.

- While levels of excess mortality in the Canadian population in early COVID years appear lower than international comparisons, 2022 levels of mortality have increased. It will be important to monitor how this develops when assessing whether a plan’s pre-pandemic assumptions (baseline and improvements) remain appropriate.

- It is still too early to tell the long-term impact of the pandemic on longevity. There are arguments to support effects both increasing and decreasing longevity. For example, previous COVID infections may have long term negative health effects reducing future longevity; or alternatively, developments of mRNA technology may spur on medical advances that will increase future longevity. Practitioners should consider the balance of such effects when considering potential future impacts of the pandemic.

- Mortality assumptions are contingent on COVID outlook, whether COVID is perceived to have a transient short-term impact and/or a long-term impact, or even no impact at all. Adjustments to the baseline and/or improvement assumptions of a plan will be influenced by the expected future impact of COVID on longevity.

Given the amount of uncertainty introduced by the pandemic, we suggest that it is appropriate to introduce some flexibility over calibration parameters into the model to allow practitioners the ability to reflect a range of reasonable outlooks for future improvements. This would align with the approach taken by the Continuous Mortality Investigation (CMI) in the UK, on whose work a lot of the research in the CIA’s report is based.

Read Club Vita’s Further thoughts on the CIA’s Mortality Improvements Research series for a deeper dive into each of these considerations.

Alexandra Sonnenwirth, Director of Client Delivery, Club Vita

Alex joined Club Vita in 2022 and focuses on business development and the delivery of longevity analytics and insights to both pension plans and (re)insurers across North America. She has a wealth of knowledge on Canada's group annuity market, with over 5 years of pension risk transfer experience and having advised on over $4B in transacted DB liability.

Erik Pickett, Actuary and Chief Content Officer, Club Vita

Erik leads the dissemination of Club Vita's insights and analytics across its US, Canadian and UK geographies. He began his career as a mathematician, working at a number of universities around Europe, while moonlighting as a part time street performer. He transitioned to the world of actuarial science in 2011, retaining his passion for engaging communication, training first as a pensions actuary with Mercer and Hymans Robertson and later specializing in longevity analytics with Club Vita.