Articles of Interest

Why Balanced Portfolios Have Failed And What Can Allocators Do About It?

We all know what happened in 2022 across financial markets. Both equity and debt markets had some of their poorest years in over a decade. The S&P 500 was down 19% while bonds did not fare much better, the iShares Core U.S. Aggregate Bond ETF was down 13%.

The safety that bonds were supposed to provide a portfolio essentially disappeared. What if we were to say that this is not a one-time thing and the safety that bonds once offered to a pension’s portfolio had disappeared slowly over time and the balanced approach (60% equity 40% bonds) to investing is not as safe as it once was?

As the Federal Reserve, Bank of Canada, and other Central Banks across the world increased interest rates in 2022 in response to soaring inflation, bonds, and stocks both were hit hard. This left many investors questioning their advisors, planners, or allocators. The balanced portfolios that they had been sold for decades were supposed to hold up when equity markets underperformed. The balanced approach to investing, invests in both stocks and bonds seeking a balance between growth and capital preservation while seeking to limit portfolio volatility.

This strategy worked in previous decades when equity markets had major drawdowns. This obviously did not occur in 2022. Every balanced strategy had major losses in 2022. In terms of ETFs that have a balanced mandate iShares have numerous strategies, in 2022 the 80/20 (stock, bond) was down 16%, the 60/40 was down 15%, the 40/60 was down 15%, and the 30/70 was down 14%. However, as we said earlier, 2022 is not an outlier. Over the last 15 years, these strategies had negative returns in three other years, 2008, 2015, and 2018 (fund inception dates in 2008).

Why has this happened?

Interest rates.

Interest rates have declined for over 40 years. Interest rates simply did not have more room to decrease to benefit an investor's balanced portfolio. When equity markets underperformed over a year in past decades, rates were cut, and bonds outperformed, preserving the capital of balanced investors. Fast forward to today when interest rates have been close to zero for almost 5-10 years and rates cannot decrease enough to nullify the losses of drawdowns across equity markets in a balanced portfolio.

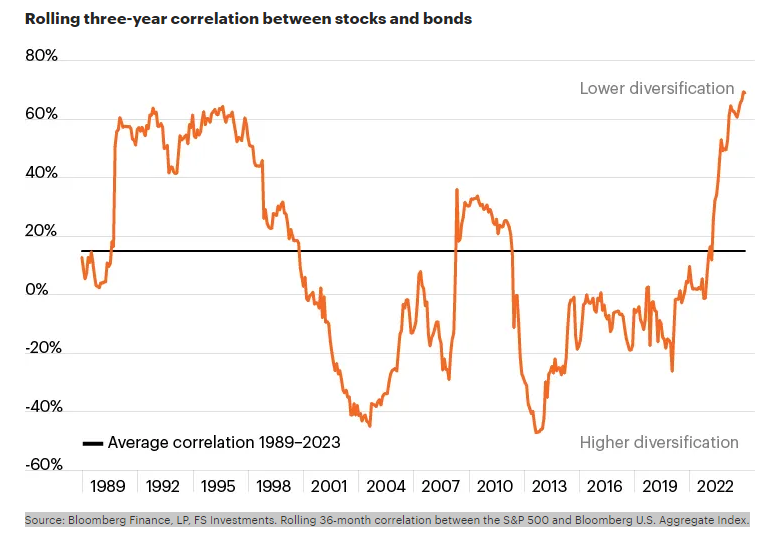

Rewind to 1981, the U.S. 10 Year Treasury Bond was yielding close to 16%, 40 years later the same bond was yielding less than 0.5%. The massive decline in interest rates has caused the correlation of equity and debt markets to increase rapidly over time. This reduces the diversification factor between stocks and bonds. According to FS Investments, the correlation (rolling 3-year returns) between stocks and bonds ended 2023 at a 40-year high. The higher the correlation between two assets in a portfolio leads to less diversification.

The whole point for investors investing in a balanced approach was to benefit from diversification and blend capital preservation with growth. When that diversification disappears between stocks and bonds, it's time to look elsewhere. The balanced approach to investing is also in theory supposed to limit portfolio volatility, however, in recent years according to JP Morgan bond volatility has increased. This has caused the balanced strategy to have high volatility over the last 10-15 years where its volatility is approaching the volatility of some equity markets (10-year volatility: 60/40 Target Allocation Fund Blackrock 11.86%, iShares MSCI World Index 12.43% (as of June 30, 2024))1.

Before you say this is backward looking as interest rates have already moved up, and rates are not 0% like in 2020, they are closer to 5%. We think that low interest rates are the new normal and will remain relatively low moving forward, the global economy has shown it cannot handle higher rates as Central Banks and governments around the world have walked themselves into a corner through excessive leverage.

We know the balanced strategy has major drawdowns at these interest rate levels by just rewinding to 2008. Before the Financial Crisis in 2007, interest rates were at a similar level to that of today, despite massive rate cuts the balanced strategy still had a large drawdown. According to RBC, the RBC Select Balanced Strategy (61% equity, 36% debt, 3% cash (as of May 2024)) was down over 15% in 2008. At these levels, interest rates simply cannot decline enough to offset equity market drawdowns. Essentially, the balanced portfolio will not do what it is intended to do moving forward and will cause a performance drag on a portfolio relative to a pure equity portfolio while only slightly reducing its volatility.

We have thought this strategy has been flawed for quite some time. Instead of sitting on our hands, we looked for alternatives that would benefit our investors.

The solution: alternative assets

Since 2008, fixed income has not worked for the most part. Asset managers with access have instead turned to alternative assets to provide absolute returns to their investors or beneficiaries.

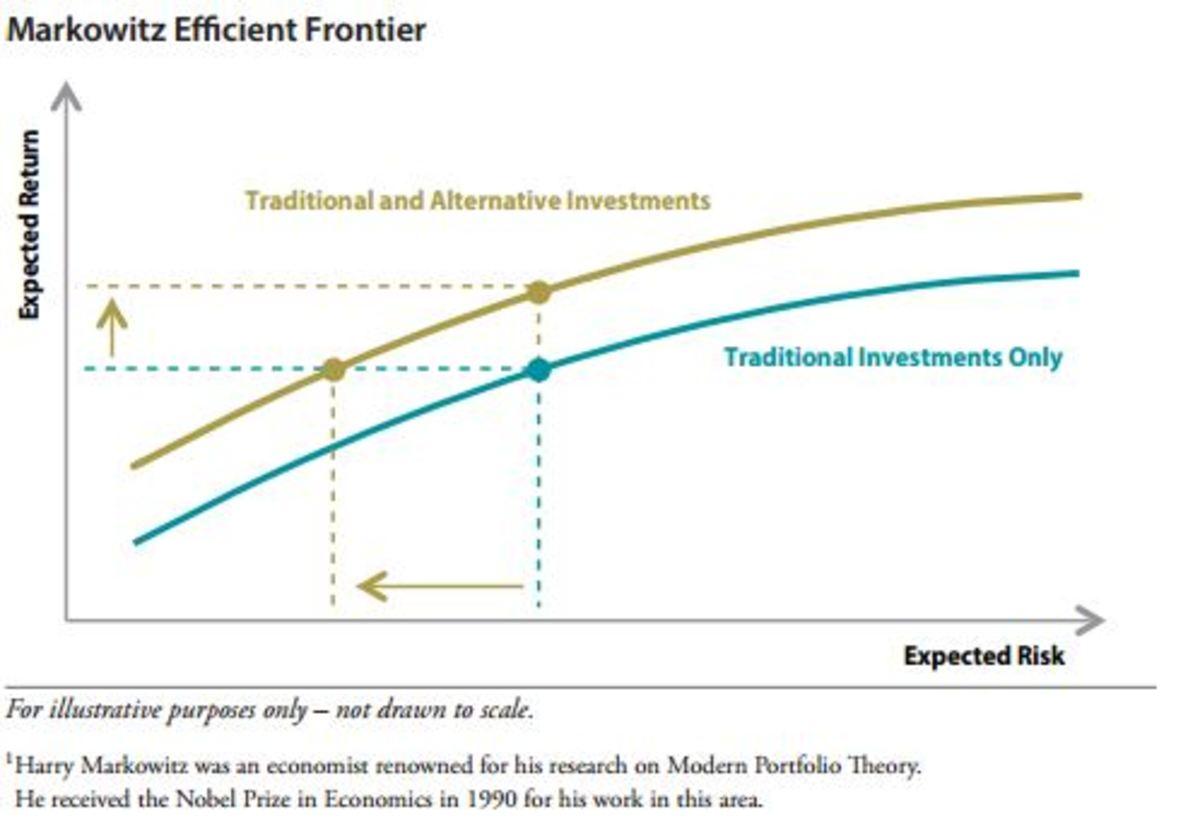

Before we dive into the weeds, let's define alternative assets. Alternative assets are defined by Investopedia as financial assets that do not fit into the conventional equity, debt, or cash asset classes. Examples of alternative assets include private equity, hedge funds, real estate, commodities, and collectibles. In comparison to bonds, alternative assets have a low correlation to public markets. Alternative assets reduce overall portfolio volatility through diversification and often have the potential for higher returns compared to traditional investments. This increases the Efficient Frontier for a portfolio (the efficient portfolio comprises investment portfolios that offer the highest expected return for a specific level of risk).

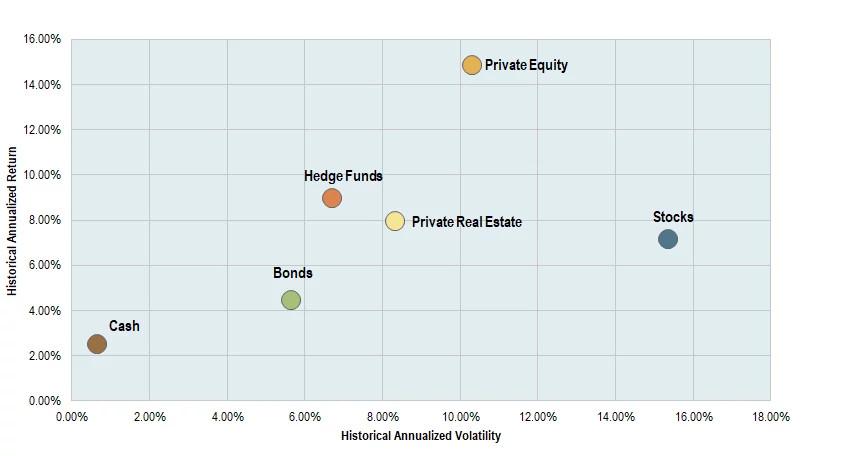

Managers have followed numerous large pension plans in allocating to alternative assets over the last decade and a half. Alternative assets historically reduce a portfolio’s volatility without negatively impacting its return. This relationship enhances the risk-return of a portfolio.

Alternative assets are in an area of their own where they provide investors with bond-like volatility with equity-like returns. Alternative assets also provide investors with access to unique strategies, manager expertise, higher Sharpe ratios for a portfolio, access to a rapidly growing market, and access to less expensive assets relative to public markets (valuations).

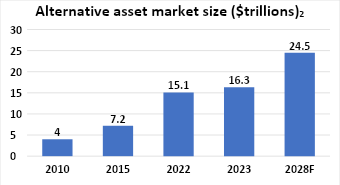

The alternative asset market has grown rapidly over the last 10-15 years and is expected to continue to grow moving forward. According to Preqin, the alternative asset market is expected to grow to $24.5 trillion by 2028.

Moving forward

Looking forward, we continue to be a believer in alternative assets for all investors including pension plans. We believe that allocators should consider alternatives when creating their investment policy statements. We also believe that accessibility to alternatives should continue to increase as it has in recent years where even small allocators can access these unique strategies and opportunities. The diversification that alternative assets provide an investor cannot be matched across public markets. We continue to believe that bonds will be volatile moving forward and that the balanced approach to investing will fail investors as it has over the last 15-20 years. Nonetheless, pension allocators and stakeholders must comprehend the potential risks of a balanced approach to investing and look for alternatives moving forward.

Sources:

- Bloomberg, Yahoo Finance, Blackrock Historical ETF returns

- Future of Alternatives 2028, Preqin

Ken Reid, CIM, Research Associate, MacNicol & Associates Asset Management

Ken is a Research Associate at MacNicol focusing on North American equities.

Prior to MacNicol Ken worked as a tax accountant and junior financial planner at small firms in the GTA as apart of his Co-operative education program.

Ken completed his Bachelor of Commerce with honours in 2021, majoring in finance and minoring in economics at the Ted Rogers School of Management.

Ken completed his Chartered Investment Manager (CIM) in June 2024 and is currently taking his CFA.

Joseph Pochodyniak, CFA, Portfolio Manager, MacNicol & Associates Asset Management

Joseph is a Senior Portfolio Manager at MacNicol & Associates focused on Real Estate, Private Equity, Hedge Funds and alternative asset class strategies. Joseph has over fifteen years of professional experience in asset management and private investment counseling. Prior to joining MacNicol & Associates, Joseph was a Portfolio Manager with a Global Macro ETF strategist and a boutique style investment counseling firm focused on publicly traded dividend paying stocks.

Earlier in his career Joseph worked for a bank-owned investment counseling and asset management firm. Joseph is a CFA Charter holder (2005 and obtained his Derivatives Market Specialist and FCSI designations from the Canadian Securities Institute in 2006. Joseph is a graduate of the University of Toronto where he earned a B.Sc. in 1999.